While COVID-19 continues to pose unprecedented challenges to U.S. society, businesses, and the economy, the impact on infrastructure projects has begun to emerge.

This word cloud provides a glimpse into the mindset of today’s harried municipal and public leadership. It is the output of a search on the words “COVID” + “Operate”, sourced from the meeting minutes of some of the largest U.S. cities and associated water, power, and transit infrastructure services.

In this blog we share observations and anecdotal examples of municipal responses from the perspective of policies, contracts, and financing. This points to how we can use analytics to yield actionable insights for service providers to critical U.S. markets.

COVID-19 Municipal Policy Responses

As the country's response to the pandemic progresses, municipalities and associated utilities have implemented massive numbers of policies, many of which have infrastructure implications.

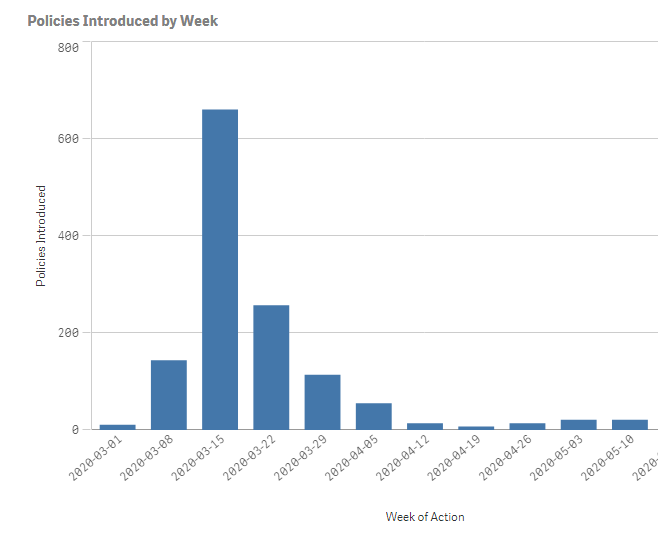

At a 'macro' level, the National League of Cities and Bloomberg Philanthropies maintain a Local Action Tracker for community-level COVID-19 responses. As of May 20, 2020, there are nearly 1,700 policies tracked across almost 500 cities. The number of policies reportedly enacted per week peaked in March with more than 600.

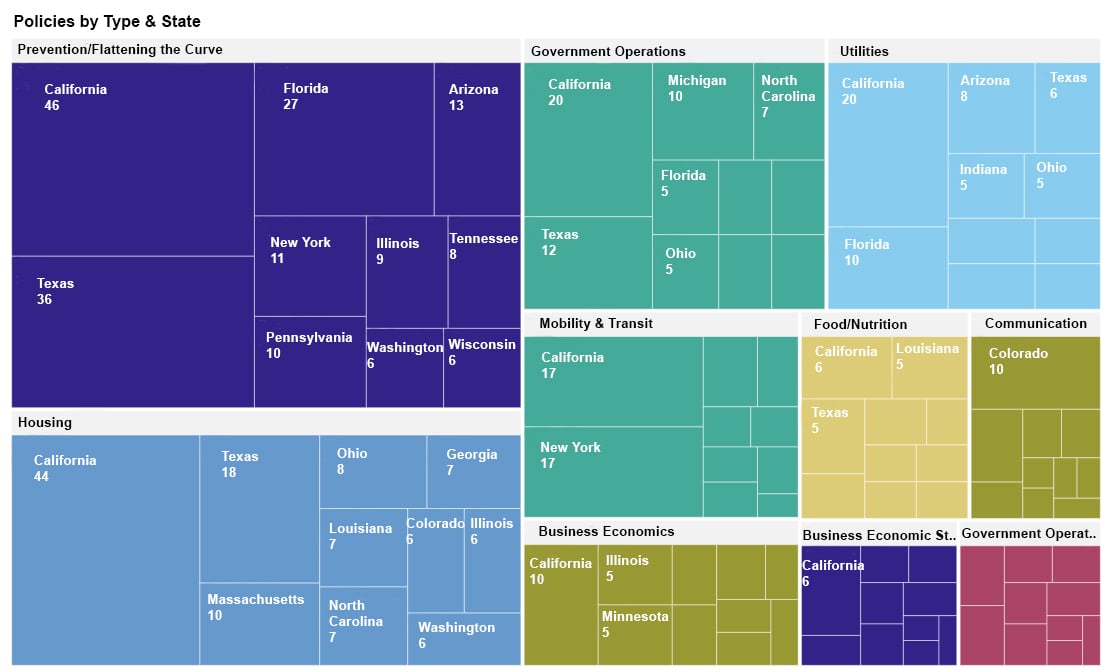

The following treemap shows the top 10 types of policies introduced, along with the top 10 U.S. states for each of those policy types. The treemap helps readers visualize the data from the Local Action Tracker. Note that with a treemap diagram, the larger the area, the higher the number of that type. California, Texas, Florida, and New York are responsible for many of the policies, which is not a surprise given the population and number of municipalities in those states.

Policies enacted at the municipal level will deeply impact both citizens and service providers for years to come. With this in mind, let’s talk about some specific examples relating to infrastructure.

Policies and Pressures on Water, Power, and Transit Infrastructure

With regards to water infrastructure, municipalities and utilities have announced the suspension of water shutoffs, late payment fees, and, in some cases, restoration of suspended accounts. The American Water Works Association (AWWA) reported that almost 75% of utilities surveyed are currently experiencing or expect revenue loss. Many services already implemented budgetary cutbacks, which can result in maintenance/repair schedule changes and possibly, capital construction delays. Along similar lines, the Indiana Chamber of Commerce conducted a survey in April, which resulted in 80% of service providers reporting revenue loss.

Respecting power utilities, similar financial pressures apply with utilities continuing to provide services to their entire customer base with or without payment. Some jurisdictions, including Iowa, are already planning to allow power shut-offs again on a tiered schedule. In addition, there are impacts specifically on the renewable sector. Clean energy has been one of the fastest-growing employment sectors of the U.S. economy, growing 10.4% since 2015, but during the pandemic, the power sector is faced with immense losses. There are substantial impacts on small scale renewable energy projects, as reported by the American Council on Renewable energy looking at unemployment data. The analysis found that 17.8% of workers in clean energy occupations filed for unemployment benefits in March and April.

Finally, in the transportation industry, especially public transit, budgets are suffering. Fares make up 15% to 50% of a transit system's income. Major cities are reporting massive drops in ridership. For example, New York reported a massive drop in transit ridership with around 20% less New Yorkers using the subway, a huge drop compared to last year. The San Francisco Bay Area's transit system stated it's losing $500,000 a day in lost fares.

COVID-19 and Municipal Contracts

COVID-19 will continue to have a substantial impact on service providers who rely on local businesses for much of their work. Municipalities are looking for ways to stabilize their economies and budgets.

Some are going back to their vendors and opening up dialogues about cost-cutting and reduction of existing notes. Take New York for instance, as the COVID-19 epicenter. Looking at one infrastructure service, MTA is renegotiating contracts. For example, in March 2020, the MTA requested from Proudfoot additional post-BAFO (Best and Final Offer) concession. As a result, they reduced the initial proposal of $7,204,872 by over 35% down to $4,636,771. MTA also worked with Ernst & Young, U.S. LLP, who agreed to reduce their total contract by almost $7 million, lowering their proposed cost of $66,014,032 to $59,038,000. Ernst & Young also offered to provide a Crisis Recovery Team of eight individuals for six weeks at no cost. It is important to remember that pre-COVID, there was an ongoing lawsuit between MTA and a group representing 1000s of contractors relating to tough contracting practices, as reported by the WSJ.

On the other hand, COVID-19 is also generating additional municipal business for some service providers. The Denver City Council recently approved a Purchase Order (PO) between the City and County of Denver and Insight Public Sector, Inc. to review the agreement for the City's Enterprise Software Products with Microsoft. The PO with Insight Public Sector was approved for nearly $3.8M, helping enable City employees to work remotely as part of the pandemic response.

The federal government has been active in trying to backstop overall financial weaknesses in the economy, and this will certainly impact future municipal and utility spending. The $2.2 trillion, 1800-page CARES Act authorized both immediate cash payments and business loan programs focused on paycheck protection. The HEROES Act, which intends to provide additional direct payments as well as substantial funding to municipal governments and agencies, is a second, $3 trillion bills that have passed the House and is being reviewed by the senate.

Path Forward

The financial aftermath will play out over the years, and business intelligence will help some organizations navigate the post-COVID world better than others.

Our search on the words “COVID” + “Open” in meeting minutes through mid-May yields this word cloud. It is good to see that organizations are thinking about how to reopen.

As cities reopen and move forward, so will organizations. Will it be business as usual? Probably not. Companies are looking at pivoting for a better position in the market. To make that pivot successful, business intelligence is the tool organizations must use. Armed with data, organizations are able to see the opportunities for new ventures and growth. Without the data to find new insights, companies will continue a business model that will not have the same results.

FirmoGraphs has the data companies need to pivot during and after COVID-19. Whether it is a new approach to existing markets, a change in business model, or finding a new opportunity to add to your company’s services, FirmoGraphs data will be able to help you define the information you need to make data-backed decisions. FirmoGraphs will also continue to employ our Power Search tool, watching developments in municipal infrastructure contracts as they emerge in Capital Improvement Plans (CIPs) and meeting minutes.

Set a meeting with us to learn more about the FirmoGraphs Power Search tool, and how you can optimize your positioning with actionable intelligence.

Our favored BI solution, Qlik Sense™ Enterprise, makes mashing-up multiple data sets fun and easy. Our customers find new opportunities to grow revenue, and reduce risk, by combining the Water Mart with their own proprietary CRM and market data.

Disclaimer

None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.