Mergers, Acquisitions and Your Business

Depending on your level of preparedness, M&A-related activity can lead to a peak or trough in your business this quarter and next. Have you ever been surprised when your customer bought another company, and you were squeezed out of the business?

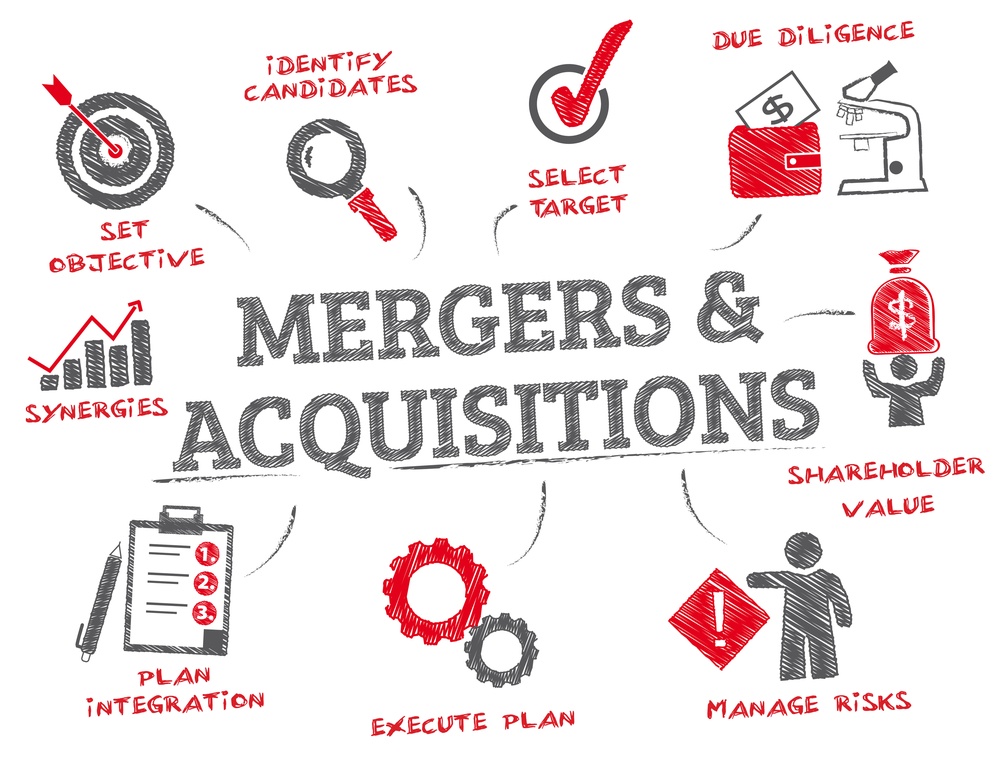

As a business leader serving North American industry, you know that mergers and acquisitions (M&A) dramatically impact your business. M&A can create substantial opportunities, or pose significant threats, to your position in an industrial account or entire markets. An informed, proactive approach around M&A optimizes your opportunity and manages your risk.

July 10th of this year a new investor-owned utility called Evergy was formed, the merger of equals between Great Plains Energy and Westar. This merger was more than 2 years in the making, requiring substantial regulatory approval as these two substantial utilities joined together. The combined company provides electric utility service to about one million customers in Kansas and another 600,000 in Missouri. If you happen to provide services to this industry, in this region, you may have known this was coming. What other M&A activity is happening in North America this month / quarter / year?

Opportunity in the Midst of M&A

Do you effectively plan around your customers' M&A, or does each event come as a surprise? During the acquisition, opportunities abound whether you are a consultant, technology provider, or both.

As a consultant, you may provide M&A-related services, starting with due-diligence. Digital business skills are in high-demand when it comes to M&A, as more records are online now, and less in traditional paper files. We remember the days of the physical "war room", full of files, and are happy to be in more of a digital age. The better your team is at digital discovery, the faster you can give your acquiring customer sought knowledge.

If you are a technology provider, some of the best licensing opportunities can be associated with M&A. Generally software licenses are limited to business attributes that change in an acquisition, such as (a) revenue, (b) named users, (c) concurrent users, (d) physical site locations, (e) lines of business. If you are not tracking customer M&A activity, you may be leaving revenue on-the-table.

Critically, if you are well-prepared, M&A can shortcut otherwise lengthy sales cycles. One-time budgets for licensing and services are often baked-in to the budget, slashing times to close an opportunity for well-prepared providers. In these times being an existing approved vendor is helpful, although M&A can also become a shortcut to approved vendor lists when your service or technology is immediately needed.

Risk Management and M&A

Do you remember the day you expected a deal to close, only to discover that your customer is merging or acquired? If you've had to explain that loss to your boss or board, knowing that you could have known what was coming, you know that isn't an experience to repeat.

Despite the upside opportunity, major M&A activity can chill or freeze existing opportunities. Executives may temporarily lose the ability to commit funds as the dust settles. You may lose your exeuctive sponsor to the customer reconfigures organizational charts and reimagines service models. You may end up either benefitting, or hurting, from the new organization. With knowledge you may also be able to outmaneuver the competition.

There may also be nothing you can do, other than to know what is coming. That's ok. If is not ok, however, to be surprised when the M&A was public knowledge. With knowledge you, as a business leader, can adapt, minimize the damage, and inform your team and superiors what is afoot.

Wrapping Up

2017 went down as an year of big mergers. It's gone. It's up to you to decide how you want 2018 to be for you.

We all work in a competitive, evolving business environment. Your partner today could become your competitor tomorrow. If there is any potential for mergers and acquisitions in your markets, you must track understand how these changes impact your business. FirmoGraphs provides information useful as you update your go-to-market plans, and evaluate risks and opportunities in your target markets.

Be prepared, or risk missing opportunities, and ceding territory to your competition.

Merger activity is very important in the US utility market. Click here to learn more.

Click below to download our E-Book with 5 Critical Actions for Insight-Driven Marketing.

You might also want to read our blogs FirmoGraphs North American Merger and Acquisition (M&A) Report, November 2018 and FirmoGraphs North American Merger and Acquisition (M&A) Report, October 2018

Disclaimer

None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.

Tags:

Business Intelligence, Qlik, mergers, customer relationships, acquisitions, acquisition trends