February 2022 Water and Wastewater Market Recap is a recap of some of the most interesting and useful water industry news from February 2022. It contains updates on industry drivers, notable projects, and recent mergers and acquisitions, as well as some interesting reads, and upcoming upcoming meetings and conferences.

Industry Drivers

Our data team tracks major developments in the water industry, which we call drivers. Here are some of the most important drivers from last month.

Massachusetts Notification Requirements to Promote Public Awareness of Sewage Pollution

Status: Proposed

Organization: Massachusetts Department of Environmental Protection

Summary: The Massachusetts Department of Environmental Protection has announced final regulations under which the permittees will notify the public of untreated wastewater into the commonwealth’s surface water. The new rules will ensure that the public has the latest information on water quality. The notification must be issued within two hours of the discovery of discharge to all local, state, and federal agencies and at least the two biggest news organizations. Besides, the permittees with combined sewer overflows (CSOs) will also be bound to maintain signage at public access points affected by CSO discharges. Municipal boards of health or health departments would also be required to issue public health warnings and post signage under certain circumstances.

Click here for more information

EPA Proposes Guidance to Support Water Affordability and Clean Water Act Implementation

Status: Proposed

Organization: Environmental Protection Agency (EPA)

Summary: On February 16, 2022, the U.S Environmental Protection Agency (EPA) asked for public comments on its Proposed 2022 Clean Water Act (CWA) Financial Capability Assessment (FCA) Guidance. The guidance outlines strategies and tools to ensure access to affordable essential water services and clean water and investment in water infrastructure projects. The guidance also explains the financial information and formulas the Agency uses to assess the financial resources a community has available to implement control measures. The comments are to be reached on or before April 25, 2022.

Click here for more information

Notable Capital Improvement Programs

Here are some recent, notable Capital Improvement Programs (CIPs). FirmoGraphs has deconstructed the CIPs into data elements, along with available project descriptions. Please feel free to request a meeting and review the data live in our business intelligence application.

Prince George's County, Maryland, Capital Spending Plan Decreased by Around 1%

According to the newly approved Capital Improvement Plan (CIP) for FY 2022-2027, the county will spend $4.77 billion on infrastructure projects ranging from public works and transportation to stormwater management. However, this period's spending has been reduced 0.92% from FY 2021/26 CIP of $4.82 billion. The following table depicts the planned capital spending of Prince George's County for current and previous CIPs and their comparison.

Spending Increases for the Construction of Roads, Bridges, and Stormwater Management

A significant part of the County's CIP 2022-27's spending will be used to improve public works and transportation. Its funding has been increased 7%, and now $656.76 million will be consumed on the construction/rehabilitation of roads, bridges, parking garages, and other facilities. For the stormwater management services, $626.8 million are earmarked with a 3.3% increase. Another $665.59 million will be spent on the Maryland-National Capital Park and Planning Commission (M-NCPPC) with increased funding of 18.1%. These three major projects will consume 40.8% of the total CIP 2022-27.

The funding for health services and education in the new CIP was increased by 21.2%, to $65.21 million, and 1.9% to $1.69 million, respectively. Funds for circuit courts were increased 5.6% to $49.14 million, and for Prince George Corrections Department, the funds increased 8% to $65.88 million. Similarly, the Fire and Emergency Medical Services Department (Fire/EMS) department budget has also been increased 6.56% to $87.4 million.

Education Facilities, the IT Office, and the Police Department Spending Decrease

Interestingly, a significant cut was made in the information technology (OIT) funds, reducing it by 52.8%, to $2.65 million. Funds for the county's Community College facilities and Memorial Library have also been trimmed 35.6% to $268 million and 12.4% to $91.24 million, respectively. Law enforcement funds were also reduced 16.4% to $68.5 million. Prince George's County Redevelopment Authority also got 28.6 % less and was earmarked $43.8 million. The revenue authority allocated $132.2 million in CIP 2022-27, 12.9 % less than CIP 2021-26. The soil conservation department's budget remained unchanged at $200 million.

Click Here to See Prince George's County, Md., CIP

Raleigh, North Carolina, Increase Planned Capital Spending at Almost 3%

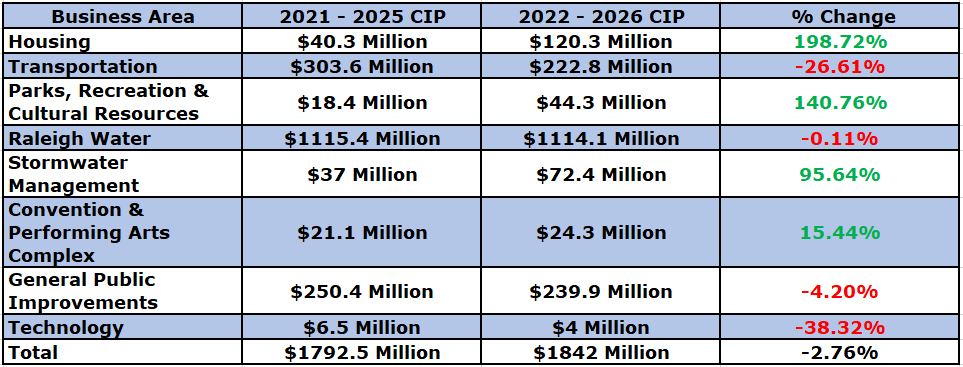

In the Capital Improvement Plan for its 2022-2026 fiscal years, the city of Raleigh, North Carolina detailed plans to spend nearly $1.84 Billion on capital projects, which is an increase of 2.76% from nearly $1.79 Billion in its 2021-2025 CIP. The table breaks down city of Raleigh planned capital spending by business area (BA) for its last two CIPs.

Housing Capital Projects Increases, Water Decreases

In this period, Property Management BA has seen the most considerable increase in the allocation, $95.3 million, which is 164.5% higher than the previous budget of $36 million. In terms of the total budget, the biggest allocation is in the Water Business Area, $1 billion, or 11.1% more than the previous budget of $962.9 million. Despite a slight decline of 5.5% in allocation for the business area of Transportation and Public Works, from $377.4 million to $356.7 million, it is the second highest in the plan.

Strong Increase in Capital Project Size

Raleigh’s’ current CIP contains 243 projects in total. It contains 2 projects that are valued at more than $100 Million and 18 projects valued at more than $25 Million. With the current and previous CIP, Raleigh Water Business Area is still the largest, so it’s not a surprise that the project with the highest value is a $150 Million sewer project. The City of Raleigh is also planning to spend $170 Million Building and Real Estate particularly Civic Campus project in the next 5 years.

Click Here to See Raleigh, NC, CIP

Notable M&A

The following M&A transactions in the Power Generation and Supply Industry stand out in the month of February:

- On February 7, 2022, Aqua Texas, a subsidiary of Essential Utilities agreed to acquire water treatment and distribution system of the Southern Oaks Water System in Freestone County, Texas.

- On February 14, 2022, New Jersey American Water signed an agreement to purchase the wastewater collection system of the Borough of Bound Brook, N.J. for $5 million.

- On February 24, 2022, NW Natural Water Company agreed to acquire two water utilities in Texas.

What We Are Reading

Here are some recent articles our team has been reading:

- N.J. launches Water Infrastructure Investment Plan

- Planned Calif. desalination plant faces final permit

- Orange County launches PFAS water treatment plant

- Texas Water Development Board today approved financial assistance totaling $29,784,375 for water, wastewater, and flood projects

- Newark Completes Lead Service Line Replacement Program

- Ohio announces $160M in water infrastructure loans

Meeting Planner

Organizations have shifted their event strategies during the COVID-19 pandemic. We are tracking these changing meeting plans.

Meetings in February and March 2022

- PA-AWWA PRWA Annual Conference - Mar. 21 - Mar 24, 2022

- WEF Public Health and Water Conference & Wastewater Disease Surveillance Summit - Mar. 21 - Mar 24, 2022

- AWE IWA Leading Edge Conference on Water and Wastewater Technologies - Mar. 27 - Apr. 2, 2022

- AWE Sustainable Water Management - Mar. 27 - Mar. 30, 2022

- AWWA Sustainable Water Management Conference - Mar. 27 - Mar. 30, 2022

- MO-AWWA & MWEA Joint Annual Meeting - Mar. 27 - Mar. 30, 2022

- AWWA Pipeline Condition Assessment Seminar: Developing Water Utility Action Plans - Mar. 28 - Mar. 30, 2022

- TAWWA Texas Water - Apr. 4 - Apr. 7, 2022

- WEF Design-Build for Water/Wastewater Conference - Apr. 4 - Apr. 6, 2022

- ACWA CA-NV AWWA Spring Conference - Apr. 11 - Apr. 14, 2022

- ACWA International Symposium On Managed Aquifer Recharge - Apr. 11 - Apr. 15, 2022

- CA - NV AWWA Spring Conference - Apr. 11 - Apr. 14, 2022

- IN-AWWA Annual Conference - Apr. 11 - Apr. 14, 2022

- AZ-AWWA Annual Conference and Exhibition - Apr. 12 - Apr. 14, 2022

- NYSAWWA New York Section’s Annual Water Event - Apr. 12 - Apr. 14, 2022

- WEF Collection Systems Conference - Apr. 19 - Apr. 22, 2022

- IMS-AWWA Water Quality And Infrastructure Midyear Conference - Apr. 21, 2022

- NACWA Water Week - Apr. 24 - Apr. 30, 2022

- AWRA Spring Conference: Water Risk Under a Rapidly Changing World - Evaluation & Adaptation - Apr. 25 - Apr. 27, 2022

- PA-AWWA Annual Conference - Apr. 25 - Apr. 27, 2022

- MT-AWWA Joint Conference - Apr. 26 - Apr. 28, 2022

- NACWA National Water Policy Fly-In - Apr. 26 - Apr. 27, 2022

- PNWS-AWWA Section Conference - Apr. 27 - Apr. 29, 2022

Early Birds Registration

- Event: TAWWA Texas Water

Dates: Apr. 4 - Apr. 4, 2022

Deadline for Early Registration: Mar. 11, 2022 - Event: AZ-AWWA Annual Conference and Exhibition

Dates: Apr. 12 - Apr. 14, 2022

Deadline for Early Registration: Mar. 12, 2022 - Event: PA-AWWA Annual Conference

Dates: Apr. 25 - Apr. 27, 2022

Deadline for Early Registration: Mar. 29, 2022 - Event: IMS-AWWA Water Quality And Infrastructure Midyear Conference

Date: Apr. 21, 2022

Deadline for Early Registration: Mar. 31, 2022 - Event: WEF AWW & AWEA Annual Conference (Arkansas)

Dates: May 1 - May 4, 2022

Deadline for Early Registration: Apr. 1, 2022 - Event: AWW&WEA Conference

Dates: May 1 - May 4, 2022

Deadline for Early Registration: Apr. 1, 2022 - Event: PNS-AWWA Section Conference

Dates: Apr. 27 - Apr. 29, 2022

Deadline for Early Registration: Apr. 1, 2022 - Event: WEF Residuals and Biosolids Conference

Dates: May 24 - May 27, 2022

Deadline for Early Registration: Apr. 8, 2022 - Event: AWWA ACE22

Dates: Jun. 12 - Jun. 15, 2022

Deadline for Early Registration: Apr. 22, 2022

Call for Papers

- Event: WF&M Water Finance Conference

Dates: Aug. 17 - Aug. 18, 2022

Deadline for Call for Papers: Mar. 19, 2022 - Event: AWWA Water Quality Technology Conference

Dates: Nov. 13 - Nov. 17, 2022

Deadline for Call for Papers: Mar. 30, 2022