The April 2023 Water and Wastewater Market Recap covers interesting and useful water industry news for this month. It contains updates on industry drivers, notable projects, and recent mergers and acquisitions, as well as some interesting reads, and upcoming upcoming meetings and conferences.

Industry Drivers

Our data team tracks major developments in the water industry, which we call drivers. Here are some of the most important drivers from last month.

EPA Advances PFAS Strategic Roadmap, Requests Public Input and Data to Inform Future Regulations under CERCLA

Status: Proposed

Organization: U.S. Environmental Protection Agency (EPA)

Summary: On April 13, 2023, the U.S. Environmental Protection Agency (EPA) recently issued an Advance Notice of Proposed Rulemaking (ANPRM), inviting public input regarding the possible harmful substance designations of per- and polyfluoroalkyl substances (PFAS) under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA). The EPA seeks feedback on whether to designate additional PFAS, such as HFPO-DA and Certain PFAS compounds that break down in the environment and form other PFAS compounds and whether certain PFAS compounds should be grouped or categorized. The ANPRM will remain open for 60 days until June 12, 2023.

Click Here for More Information

Notable Capital Improvement Programs

Here are some recent, notable Capital Improvement Programs (CIPs). FirmoGraphs has deconstructed the CIPs into data elements, along with available project descriptions. Please feel free to request a meeting and review the data live in our business intelligence application.

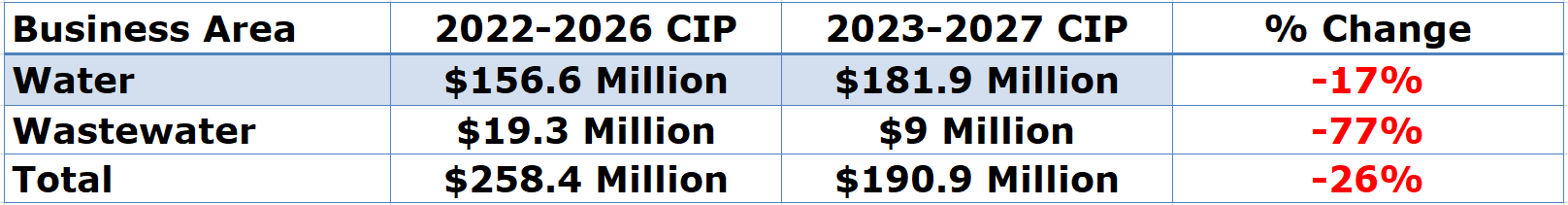

Florida Keys Aqueduct Authority Planned Capital Spending Decreases by 26%

In the CIP covering the 2023-2027 fiscal years, Florida Keys Aqueduct Authority (FKAA) detailed plans to spend $190.9 million on capital projects, a decrease of 26% from $258.4 million in its 2022-2026 CIP. The current CIP has 50 discrete line items, compared to 55 line items in the prior CIP. The table below breaks down the FKAA’s planned capital spending by business area for its last two CIPs.

Business Areas Decreases Due to Projects Near Completion

The Water Business Area decreased by 17% to $181.9 million. The $36 million decrease goes to projects near completion, such as the Stock Island Reverse Osmosis, worth $36 million. The wastewater category also decreases due to the ongoing Big Coppitt Treatment Plant Expansion and Big Coppitt Wastewater Reclamation Facility Expansion amounting to $14 million each and will be completed in 2024.

Two Projects Will Receive Over $25 Million of Investment

Florida Keys Aqueduct Authority has two notable projects valued at more than $25 million, both belonging to the Water business area. The largest project is the Islamorada Transmission Line Replacement (MM79-84), worth $33 million. The replacement is due to the high risk of failure identified in Islamorada’s main transmission line. In addition, $29 million is planned for the Kermit H Lewin Reverse Osmosis Facility to develop a 4 million gallons per day (MGD) water production facility on Stock Island.

Click Here to See Florida Keys Aqueduct Authority CIP

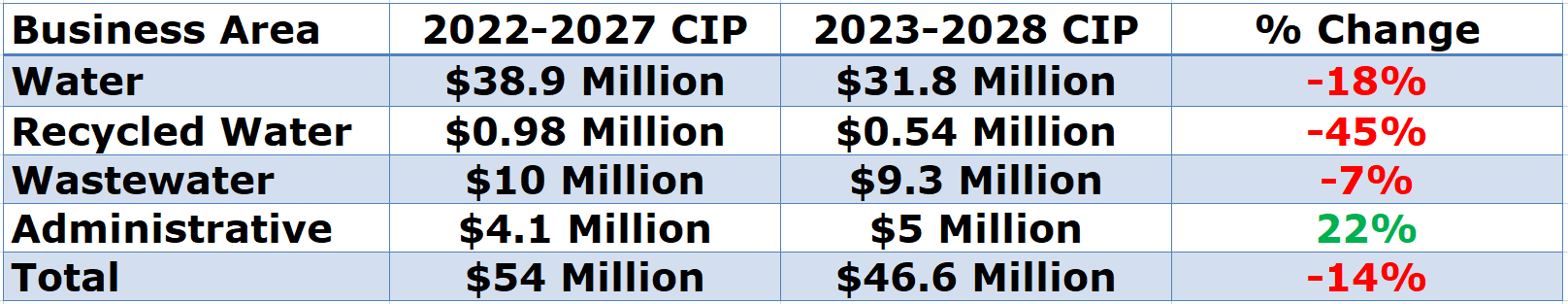

Fallbrook Public Utilities District Planned Capital Expenditure Decreased by 14%

In the CIP covering the 2023-2028 fiscal years, Fallbrook Public Utilities District (FBUD) detailed plans to spend $59.4 million on capital projects, an increase of 10% from $54 million in its 2022-2027 CIP. The current and prior CIP both have 20 discrete line items. The table below breaks down FBUD’s planned capital spending by business area for its last two CIPs.

Most Significant Decrease Planned for Water Business Area

Almost all the business areas in the current CIP decreased. The most significant decrease is the Water Category, from $38.9 million to $31.8 million. The reduction is due to the completed project in 2022, the Santa Margarita River Conjunctive Project Use Construction, worth $8.5 million.

Over $20 Million Investment for Water-Related Project

The FBUD has one significant project valued at $23.7 million, the Pipeline Replacement Projects by Contractors, under the Water business area. The project will replace about 7,500 linear feet of the main line on various streets with pipe diameters ranging from 6 to 12 inches.

Click Here to See Fallbrook Public Utilities District, California, CIP

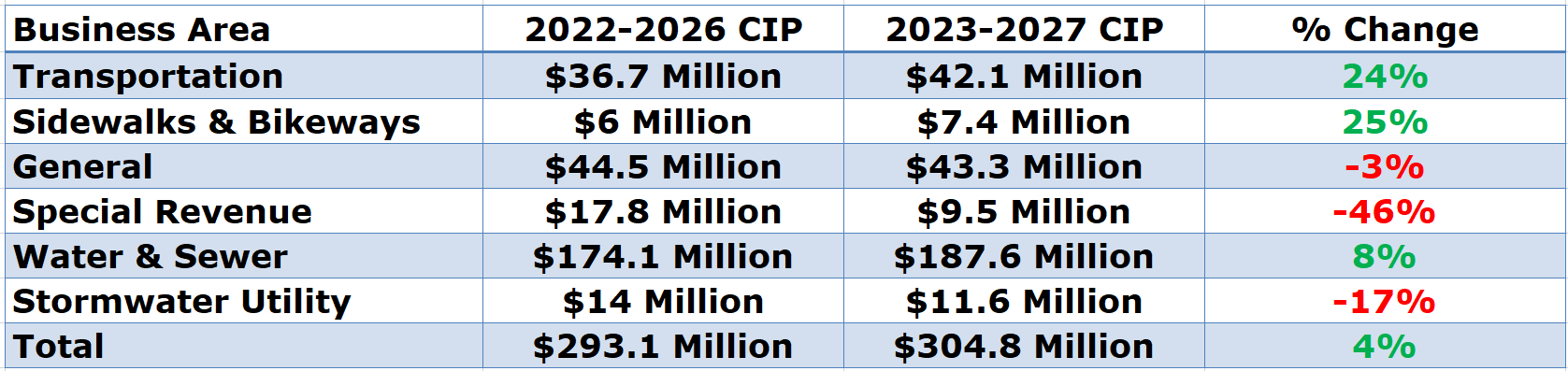

City of Melbourne, Florida, Planned Capital Program Increased by 4%

In the CIP covering the 2023-2027 fiscal years, City of Melbourne, Florida detailed plans to spend $304.8 million on capital projects, an increase of 4% from $293.1 million in its 2022-2026 CIP. The current CIP has 221 discrete line items, compared to 198 line items in the prior CIP. The table below breaks down Melbourne's planned capital spending by business area for its last two CIPs.

Largest Increase in Water and Sewer Business Area

Planned spending in the Water and Sewer category increased by 8% to $187.6 million. The increase goes to funding existing projects, including the Improvements to the Water Treatment and Production Facilities valued at $16 million and the construction of the new 36” Water Main from the Water Treatment Plant to the Distribution System, worth $6 million. The Transportation category also increased by 24% or $8.7 million for the same reason.

Notable Project Worth $40 Million

The City of Melbourne has one notable project, Reverse Osmosis Water Treatment Plant Expansion, valued at $40 million, and it's under the Water and Sewer category. As of now, there are no additional details about the project in the current CIP.

Click Here to See City of Melbourne, Florida, CIP

Notable M&A

The following M&A transactions in the Water and Wastewater Industry stand out in the month of April:

What We Are Reading

Here are some recent articles our team has been reading:

- Shimmick to secure contract for Chattanooga’s $58 million stormwater management project

- Interior invests $585M for water infrastructure in West

- Governor Hochul Announces Over $70 Million Investment in Critical Water Infrastructure Projects Across New York State

- Puerto Rico, USVI to receive $108 million to upgrade water systems

- 83 projects awarded $585 million to improve aging water infrastructure, advance drought resilience

- EPA finds more than 9 million lead pipes supplying drinking water throughout the U.S.

- Florida has the most lead pipes in the U.S. and is getting $376 million for drinking water upgrades

- Cities Initiative Commends U.S. EPA for Ensuring Great Lakes States Receive Appropriate Share of Federal Funding for Lead Service Line Replacement

- Biden-Harris Administration Announces $6.5 Billion for Drinking Water Infrastructure Upgrades Across the Country

- No lead water lines in RI in 10 years? Bill would require cataloguing, replacement.

- Biden administration to send nearly $80M to Iowa to improve water infrastructure

- EPA Recognizes Excellence and Innovation in Clean Water and Drinking Water Infrastructure Projects through the AQUARIUS and PISCES Award Programs

- Governor Hochul to invest over $70 million in critical water infrastructure projects across New York

- City of Toledo to spend $175 million on “critical fix” for water intake pipeline

- New York to invest $425M in next water infrastructure funding round

- Tennessee announces $232 million in additional funding for water infrastructure

- EPA takes first-ever federal Clean Water Act enforcement action to address PFAS discharges at Washington Works facility near Parkersburg, W. Va.

- EPA: Indiana could spend billions to replace lead-lined water pipes

- A decade into the work, Chicago is finally taking out toxic lead pipes when it replaces water mains

- Indiana is leading the charge in locating lead service lines, but more research is still needed

Meeting Planner

There is no replacement for face-to-face meetings with your prospects and customers! We track meetings of interest to our customers serving the US water and wastewater industry industry so you won’t miss upcoming meetings and deadlines. Also, FirmoGraphs has recently implemented a free-of-charge service for tracking notable infrastructure events.

Meetings in May and June 2023

|

Name Organization |

Name Meeting Key |

Date Start |

Date End |

|

Vermont Rural Water Association |

2023-05-10 |

2023-05-11 |

|

|

North Carolina Rural Water Association |

2023-05-15 |

2023-05-18 |

|

|

Water Environment Federation |

2023-05-16 |

2023-05-19 |

|

|

Water Environment Federation |

2023-05-16 |

2023-05-19 |

|

|

Alliance of Indiana Rural Water |

2023-05-18 |

2023-05-18 |

|

|

Tennessee Utility Assistance, LLC |

2023-05-18 |

2023-05-18 |

|

|

Alabama Rural Water Association |

ARWA Alabama Rural Water Association AL/FL Joint Technical Training Conference |

2023-05-23 |

2023-05-25 |

|

Alliance of Indiana Rural Water |

2023-05-25 |

2023-05-25 |

|

|

Water Environment Federation |

2023-06-06 |

2023-06-09 |

|

|

American Water Works Association |

2023-06-11 |

2023-06-14 |

|

|

Water Environment Federation |

2023-06-27 |

2023-06-30 |

|

|

Water Environment Federation |

2023-06-27 |

2023-06-29 |

Call for Papers

- Event: AIRW Annual Fall Conference

Dates: October 17-19, 2023

Deadline for Call for Papers: June 30, 2023

Early Bird Registrations

- Event: ESWP The International Bridge

Dates: June 12-14, 2023

Deadline for Early Registration: May 12, 2023 - Event: AWRA Summer Conference

Dates: July 17-19, 2023

Deadline for Early Registration: May 19, 2023