The August 2023 Water and Wastewater Market Recap covers interesting and useful water industry news for this month. It contains updates on industry drivers, notable projects, and recent mergers and acquisitions, as well as some interesting reads, and upcoming upcoming meetings and conferences.

Industry Drivers

Our data team tracks major developments in the water industry, which we call drivers. Here are some of the most important drivers from last month.

EPA Issues Next Test Order Under National Testing Strategy for PFAS Used in Chemical Manufacturing

Status: Proposed

Organization: U.S. Environmental Protection Agency (EPA)

Summary: On August 15, 2023, The U.S. Environmental Protection Agency (EPA) issued its third Toxic Substances Control Act (TSCA) test order, requiring testing on per- and polyfluoroalkyl substances (PFAS) under its National PFAS Testing Strategy. The order aims to understand better the potential hazards and exposures linked to HFPO-DAF and structurally similar PFAS compounds, improving overall data on PFAS. The order targets various companies, and mandates testing on a substance used in organic chemical manufacturing. EPA's decision concerns the lack of information regarding the potential health risks posed by PFAS. The test order follows a tiered testing process, with the first-tier results required to be submitted within 446 days. The collected data will be made publicly available, subject to confidentiality considerations.

Click Here for More Information

EPA Releases Initial Nationwide Monitoring Data on 29 PFAS and Lithium

Status: Proposed

Organization: U.S. Environmental Protection Agency (EPA)

Summary: On August 17, 2023, the U.S. Environmental Protection Agency (EPA) unveiled the first batch of data gathered as part of the fifth Unregulated Contaminant Monitoring Rule (UCMR 5), aimed at tackling per- and polyfluoroalkyl substances (PFAS) in drinking water. The program monitors 29 PFAS compounds and lithium to understand their prevalence and concentrations within the country's drinking water systems. This monitoring data will provide a foundation for evidence-based decision-making and aid in evaluating the extent of national-level exposure to these chemicals, particularly in areas with environmental justice concerns. The initial data release constitutes approximately 7% of the anticipated outcomes obtained over the next three years. The EPA intends to periodically update and share this information through the National Contaminant Occurrence Database (NCOD) until the data reporting process concludes in 2026.

Click Here for More Information

New York State Governor Hochul Signs Bill to Protect the Hudson River From Indian Point Decommissioning Wastewater

Status: Effective

Organization: New York State Department of Public Service

Summary: On August 18, 2023, the New York State Governor signed S6893 into law to protect the Hudson River from radioactive pollution caused by the decommissioning of nuclear power plants. The bill makes it unlawful to discharge any radiological substance into the river in connection with dismantling such facilities unless it is authorized by federal law. The legislation also gives the attorney general the power to enforce this prohibition and seek civil penalties for any violations. In addition, the bill is one of several measures proposed or enacted in New York to address the issue of nuclear power plant closure and cleanup, especially concerning the Indian Point Energy Center, which ceased operations in April 2021.

Click Here for More Information

Notable Capital Improvement Programs

Here are some recent, notable Capital Improvement Programs (CIPs). FirmoGraphs has deconstructed the CIPs into data elements, along with available project descriptions. Please feel free to request a meeting and review the data live in our business intelligence application.

Cape Fear Public Utility Authority, North Carolina, Planned Capital Program Increased By 27%

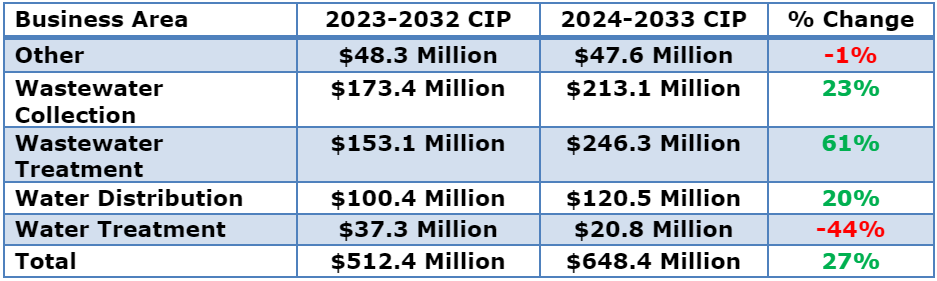

In the CIP covering the 2024-2033 fiscal year, North Carolina’s Cape Fear Public Utility Authority detailed plans to spend $648 million on capital projects, an increase of 27% from $512 million in its 2023-2032 CIP. The current CIP has 55 line items, compared to 62 line items in the prior CIP. The table below breaks down Cape Fear’s planned capital spending by business area for its last two CIPs.

Most Significant Increase in Water Treatment Category

Planned spending in Wastewater Treatment increased by 61% or $93 million. The increase goes to constructing the Southside Wastewater Treatment Plant (WWTP) Replacement/Capacity Upgrade from $150 million to nearly $250 million, starting in Fiscal Year (FY) 2025. The Wastewater Collection also increased with funding for existing projects. Meanwhile, the Water Treatment category decreased by 44% due to integrating the two water distribution systems under the Richardson WTP 3 MGD Expansion, reducing capital and annual operating costs.

Over $200 Million of Investment of Wastewater Treatment Plant

Cape Fear Public Utility Authority has one project valued at over $200 million. The project is the Southside Wastewater Treatment Plant (WWTP) Replacement/Capacity Upgrade, worth $246 million, under the Wastewater Treatment category. 75% of the project cost goes to replacing the existing aging infrastructure of the treatment plant, and 25% is related to expansion.

Click Here to See Cape Fear Public Utility Authority, North Carolina, CIP

Notable M&A

The following M&A transactions in the Water and Wastewater Industry stand out in the month of August:

What We Are Reading

Here are some recent articles our team has been reading:

- Wisconsin governor greenlights funds for PFAS eradication in stormwater, sewer systems

- EPA allocates $450 million to improve water infrastructure in four states

- EPA Takes Action to Protect Delaware River and to Hold Delhi, NY Company Accountable for Violating Clean Water Act and Clean Air Act

- Ohio governor awards $135 million to 90 water infrastructure improvement projects

- Texas awards $1.59B for water infrastructure projects

- Kent County Water Authority joins PFAS groundwater contamination lawsuit against 3M, Dupont

- Removing PFAS from drinking water

- San Luis Obispo County, California to begin clean-up of PFAS in groundwater

- Governor Ivey pledges $67 million to 27 water and sewer projects across Alabama

- Biden-Harris Administration Announces $50 million in Available Grants to Upgrade Stormwater and Sewer Infrastructure

- California approves groundwater plans for 10 basins

- Greenville, N.C., to pursue $166 million in stormwater, public works upgrades

- Tidal Vision acquires Clear Water Services

- Biden administration allocates $200 million in federal infrastructure grants to upgrade water tunnels

- Michigan to address PFAS groundwater contamination near military base

- EGLE announces $41.5 million in MI Clean Water grants to help communities upgrade water infrastructure, protect health, environment

- Illinois EPA Invests Over a Half Billion Dollars in Drinking Water and Wastewater Projects in Fourth Quarter of FY23

- Northwest states reject federal money to find and replace dangerous lead pipes

- Virginia localities are working to limit PFAS chemical exposures

- California company fined $5 million for illegally dumping wastewater in Mississipp

Meeting Planner

There is no replacement for face-to-face meetings with your prospects and customers! We track meetings of interest to our customers serving the US water and wastewater industry so you won’t miss upcoming meetings and deadlines. Also, FirmoGraphs has recently implemented a free-of-charge service for tracking notable infrastructure events.

Meetings in September and October 2023

|

Name Organization |

Name Meeting Key |

Date Start |

Date End |

|

American Water Works Association, Minnesota Section |

2023-09-19 |

2023-09-22 |

|

|

Water Environment Federation |

2023-09-30 |

2023-10-04 |

|

|

American Water Works Association |

2023-10-03 |

2023-10-05 |

|

|

Alliance of Indiana Rural Water |

2023-10-17 |

2023-10-19 |

|

|

Association of Metropolitan Water Agencies |

2023-10-22 |

2023-10-25 |

|

|

National Onsite Wastewater Recycling Association |

2023-10-22 |

2023-10-25 |

|

|

American Water Works Association, California-Nevada Section |

2023-10-23 |

2023-10-26 |

Early Bird Registrations

Event: AWRA Annual Water Resources Conference

Dates: November 6, 2023 - November 8, 2023

Deadline for Early Registration: October 20, 2023