The October 2022 Water and Wastewater Market Recap covers interesting and useful water industry news for this month. It contains updates on industry drivers, notable projects, and recent mergers and acquisitions, as well as some interesting reads, and upcoming upcoming meetings and conferences.

Industry Drivers

Our data team tracks major developments in the water industry, which we call drivers. Here are some of the most important drivers from last month.

EPA Sends PFAS Drinking Water Regulations To OMB For Review

Status: Proposed

Organization: United States Environmental Protection (EPA)

Summary: On October 6, 2022, EPA announced the sending of the proposed rule to its Office of Management and Budget (OMB) to review drinking water regulations for two key per- and poly-fluoroalkyl substances (PFAS). If the proposal is approved, it will regulate perfluorooctanoic acid (PFOA) and perfluorooctanesulfonic acid (PFOS), two of the major PFAS in drinking water systems. In addition, the EPA will set Maximum Contaminant Levels (MCLs) for these PFAS.

Click here for more information

EPA Releases First-ever Agency-Wide Strategy to Reduce Lead Exposures and Disparities in U.S. Communities

Status: Proposed

Organization: United States Environmental Protection (EPA)

Summary: On October 27, 2022, the United States Environmental Protection (EPA) released its Strategy to Reduce Lead Exposures and Disparities in Communities. The strategy focuses on identifying communities with high lead exposure, adopting plans to reduce community exposure to lead sources and improve their health, and supporting research to reduce lead exposure and its health related impacts. In addition, EPA will monitor the progress of implementing strategies through milestones such as completing 225 Superfund cleanups of lead contamination by the fall of 2026. The work is supported by $15 billion in funding appropriated for replacing lead pipes and service lines across the U.S. through Bipartisan Infrastructure Law (BIL).

Click here for more information

Notable Capital Improvement Programs

Here are some recent, notable Capital Improvement Programs (CIPs). FirmoGraphs has deconstructed the CIPs into data elements, along with available project descriptions. Please feel free to request a meeting and review the data live in our business intelligence application.

City of Baltimore, Maryland, Planned Capital Spending Increases by Nearly 10%

In the CIP covering the 2023 - 2028 fiscal years, the City of Baltimore detailed plans to spend nearly $3.7 billion on capital projects, an increase of 9.5% from $3.3 billion in its 2022 - 2027 CIP. The current CIP has 480 discrete projects, compared to 449 projects in the prior CIP. The table below breaks down the City of Baltimore's planned capital spending by business area for its last two CIPs.

Planned Spending Cuts for Wastewater Department; New Water Department Projects

Planned spending in the Department of Public Works - Water Supply increased by 31.6% to $876.4 million. The increase goes to 28 new projects, including Montebello 1 & 2 Filtered Water Reservoir Improvements and Watershed Bridge Maintenance, worth $43.2 million and $39.8 million, respectively. The Department of General Services also increased by $66.5 million for the same reason.

The Department of Public Works - Wastewater cut its planned spending by 7.9% due to projects nearing completion, including Patapsco Wastewater Treatment Plant Headworks Upgrade, valued at $39.4 million, and Patapsco Wastewater Treatment Plant Secondary Reactor Rehabilitation, valued at $55.6 million. The ongoing Conduit Corridor Construction Project, under the Conduit category, involves the reconstruction and replacement of segments of the conduit system with new conduit manholes and duct banks decreased by $75.5 million.

Over $200 Million Investment in Sewer Projects

Baltimore has 29 notable projects. Three projects are valued at more than $100 million, and twenty-six projects are valued at more than $25 million. The largest single project is the Outfall Phase II Sewershed Improvements for 5-Year Storm Level of Protection (LOP), worth over $155 million. In addition, another $106.9 million is planned for the Gwynn's Falls Phase II Sewershed Improvements for a 5-year LOP. These two projects belong to the Department of Public Works - Wastewater, which has the highest budget in the CIP. The Department of Public Works - Water Supply also has a notable project, the Future 15 Miles Water Main Replacement, worth $120 million.

Click Here to See Burbank Water and Power Utility, CA, CIP

Great Lakes Water Authority, Michigan, Planned Capital Spending Increases by 3.5%

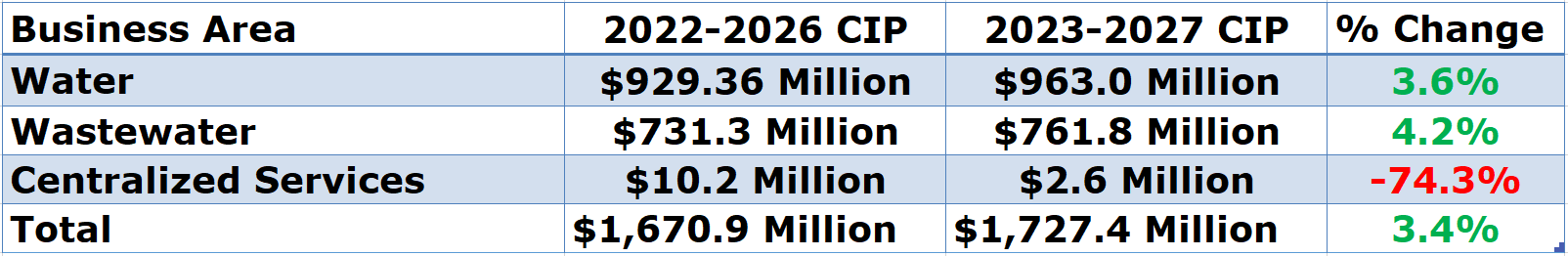

In the CIP covering the 2023 - 2027 fiscal years, the Great Lakes Water Authority detailed plans to spend over $1.7 billion on capital projects, an increase of 3.5% from $1.67 billion in its 2022 - 2026 CIP. The current CIP has 184 discrete projects, compared to 167 projects in the prior CIP. The table below breaks down the Great Lakes Water Authority’s planned capital spending by business area for its last two CIPs.

Planned Increases Due to the New Water and Wastewater Projects

Planned spending in the Water category increased by nearly 4% to $963 million. The increase is due to a $41 million newly added project, the Reservoir Inspection, Design, and Construction Management Services Phase II. Also, planned spending in the Wastewater category increased by $30 million, and it’s due to the newly added Water Resource Recovery Facility projects.. These increases are accompanied by a decrease of $7 million or 74% in the Centralized Services Category.

Over $230 Million Planned Investment in Pumping Station Projects

Great Lakes Water Authority has four projects valued at more than $100 million. The largest single project belongs to the Water category, the 96-inch Water Transmission Main Relocation and Isolation Valve Installations, valued at $170 million. This project deals with relocating around the existing superfund landfill addition of isolation valves along the 96-inch water transmission main. Listed below are the other three notable projects and their proposed spending:

- Improvements of Freud & Conner Creek Pump Station - valued at $126.1 million under the Wastewater category; project provides an operational strategy design to optimize the utilization of interconnected piping and operation between Conner Creek and Freud Pumping Stations.

- Improvements of the Springwells Water Treatment Plant, Low-lift and High-lift Pumping Station - valued at $109 million under the Water category; project comprises replacing the low and high pumping units, pump house exterior windows, and medium-voltage electrical system.

- Construction of the Water Works Park to Northeast Transmission Main - valued at $100.2 million under the Water category; consists of three-phase construction of three-phase construction to complete the water transmission system from Water Works Park to Northeast.

Click Here to See Great Lakes Water Authority, MI, CIP

Notable M&A

The following M&A transactions in the Power Generation and Supply Industry stand out in the month of October:

- On October 3, 2022, Aquarion Company completed the acquisition of The Torrington Water Company.

- On October 6, 2022, NW Natural Water Company acquired the water and wastewater utilities of Far West Water & Sewer, Inc.

What We Are Reading

Here are some recent articles our team has been reading:

- Pennsylvania approves use of $320 million in funding for water and sewer projects

- Pennsylvania allocates $236 million to 15 counties for water infrastructure renovations

- Denver Water on schedule for lead pipe replacement, awaiting additional federal approval

- DEQ seeks applications for projects to mitigate lead levels in public water supplies

- EPA announces $30 million to reduce lead in drinking water

- EPA Enforcement Actions in 2022 Help Protect Public Health and the Environment from Dangers of Lead Exposure

- EPA Unveils Historic National Lead Strategy in Omaha, Nebraska

- Interior awards $210M for drought resilience in the West

- Clean water infrastructure faces major impacts from flooding, NACWA members say

Meeting Planner

There is no replacement for face-to-face meetings with your prospects and customers! We track meetings of interest to our customers serving the US water and wastewater industry industry so you won’t miss upcoming meetings and deadlines. Also, FirmoGraphs has recently implemented a free-of-charge service for tracking notable infrastructure events.

Meetings in November and December 2022

- AWWA Water Quality Technology Conference - Nov. 13 - Nov. 17, 2022

- SCRWA Annual Conference - Nov. 14 - Nov. 16, 2022

- ACWA Fall Conference & Exhibition - Nov. 29 - Dec. 1, 2022

- MRWA Maine Rural Water Association Annual Conference & Trade Show - Dec. 6 - Dec. 8, 2022

- NGWA Groundwater Week - Dec. 6 - Dec. 8, 2022

Early Bird Registrations

- Event: ACWA Fall Conference & Exhibition

Dates: Nov. 29 - Dec. 1, 2022

Deadline for Early Registration: Nov. 11, 2022

Call for Papers

- Event: IWA Membrane Technology Conference & Exhibition

Dates: July 23 - July 26, 2023

Deadline for Call for Papers: Nov. 22, 2022 - Event: AIRW Annual Spring Conference

Dates: Mar. 14 - Mar. 16, 2023

Deadline for Call for Papers: Dec. 2, 2022