The October 2023 Water and Wastewater Market Recap covers interesting and useful water industry news for this month. It contains updates on industry drivers, notable projects, and recent mergers and acquisitions, as well as some interesting reads, and upcoming upcoming meetings and conferences.

Industry Drivers

Our data team tracks major developments in the water industry, which we call drivers. Here are some of the most important drivers from last month.

EGLE Establishes New Surface Water Values for Two Additional PFAS Chemicals

Status: Proposed

Organization: Michigan State Legislature

Summary: On October 12, 2023, the Michigan Department of Environment, Great Lakes, and Energy (EGLE) announced new water quality values (WQVs) for two PFAS chemicals: Perfluorohexanesulfonic Acid (PFHxS) and Perfluorononanoic Acid (PFNA). The new WQVs for PFHxS are 210 parts per trillion (ppt) for surface water and 59 ppt for drinking water sources. The new WQVs for PFNA are 30 ppt for surface water and 19 ppt for drinking water sources. These values are based on the risk assessment method provided in Rule 57, which considers the chemical identity, uses, volumes, byproducts, environmental and health effects, worker exposure, and disposal methods of PFAS. The new WQVs are part of EGLE's PFAS Strategic Roadmap to address the impacts of these chemicals on human health and the environment.

Click Here for More Information

EPA Finalizes Rule to Require Enhanced PFAS Reporting to the Toxics Release Inventory

Status: Proposed

Organization: U.S. Environmental Protection Agency (EPA)

Summary: On October 20, 2023, the EPA issued a final rule to enhance reporting on per- and polyfluoroalkyl substances (PFAS) to the Toxics Release Inventory (TRI). The rule eliminates an exemption that allows facilities to avoid reporting information on PFAS when used in small concentrations. The rule applies to all manufacturers and importers of PFAS and PFAS-containing articles in any year since 2011. The rule is based on a statutory requirement under the FY2020 National Defense Authorization Act (NDAA). It is part of EPA's PFAS Strategic Roadmap to address the impacts of these chemicals on human health and the environment. The rule will provide EPA, its partners, and the public with the largest-ever dataset of PFAS manufactured and used in the U.S., which will help inform future policies and regulations.

Click Here for More Information

Notable Capital Improvement Programs

Here are some recent, notable Capital Improvement Programs (CIPs). FirmoGraphs has deconstructed the CIPs into data elements, along with available project descriptions. Please feel free to request a meeting and review the data live in our business intelligence application.

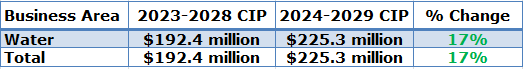

WaterOne, Kansas, Planned Capital Expenditure Increased By 17%

In the CIP covering the 2024-2029 fiscal years, Kansas' WaterOne detailed plans to spend $225 million on capital projects, an increase of 17% from $192 million in its 2023-2028 CIP. The current CIP has 189 line items, compared to 35 line items in the prior CIP. The table below breaks down WaterOne’s planned capital spending by business area for its last two CIPs.

Increase Due to New Projects

Planned spending increased by 17% due to the addition of 154 projects in the recent CIP. The increase goes mainly to the transmission main replacements, Kansas well unit replacements, Facility I Improvements Phase III, and Piping & Valve Replacement at Missouri River Intake. New projects include phase III of the Wyss pump station, a pumping station and reservoir in the northwest reduced pressure area, and an additional reservoir at the 211th St. pump station.

Addition and Expansion of Reservoir to Receive Over $40 Million

WaterOne has five notable line items in the recent CIP valued at over $10 million. The largest is the Wyss Pumping Station & Reservoir Expansion, worth $22 million. This project includes installing a 22.5 mg booster pumping unit, a 15 mg reservoir pumping unit, and constructing a 7.5 mg reservoir. Other projects are listed below.

- 211th Reservoir & Pumping Station Phase III - worth $20 million.

- Pumping Station & Reservoir - NWRPA South SubZone (71st) - worth $18 million.

- 30" TM Replc 47th St Quivira to I-635 & 51st Street - worth $14 million. This project is the replacement of a 30-inch ductile iron transmission main installed in 1963, which provides flow from the Hansen Treatment Plant to the Woodson Pump Station.

- Campus Improvements Phase II - worth $12 million.

Contact FirmoGraphs to Learn More

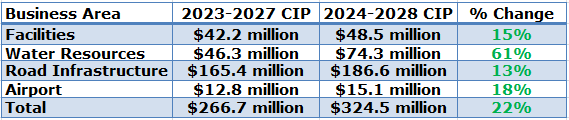

Marin County, California, Planned Capital Program Increases by 22%

In the CIP covering the 2024-2028 fiscal years, Marin County, California, detailed plans to spend close to $325 million on capital projects, an increase of 22% from $267 million in its 2023-2027 CIP. The current CIP has 45 line items, compared to 41 line items in the prior CIP. The table below breaks down Marin County’s planned capital spending by business area for its last two CIPs.

Planned Increases Goes to New Projects

All business areas increased. The most significant increase goes to the Water Resources and Road Infrastructure categories. The rise of 61% under the Water Resources goes to a new project, the Proposed Santa Venetia Floodwall Project - Flood Zone 7, and the 13% increase in the Road Infrastructure goes to the Retaining Walls project, worth $13 million.

Water Resources Projects to Receive Approximately $50 Million of Investment

Marin County has four notable projects valued at over $10 million, all in the Water Resources category. The largest project is the Proposed Santa Venetia Floodwall Project -Flood Zone 7, worth $20 million. The project will replace the existing Timber-Reinforced Berm (TRB) that protects the community from tidal flooding in Las Gallinas Creek with a new elevated floodwall. Other three projects include:

- Corte Madera Creek Flood Management Project - Zone 9 - worth $10 million. This project includes channel grading and replacing the fish ladder in the Town of Ross and in Kentfield, constructing a new pump station for the Granton Park neighborhood, adding an access ramp down into the concrete channel for maintenance, and improving the fish passage by constructing new fish resting pools in the bottom of the channel.

- Deer Island Basin Complex Tidal Restoration Design Project - worth $10 million. This project will restore the tidal marsh by widening Novato Creek upstream of Hwy 37.

- Marin City Pond And Drainage Improvements -Zone 3 - worth $10 million. This project will increase the flood conveyance from the pond by installing a pump station that pumps from the pond through the existing culvert to the Bay, in conjunction with other improvements, including a floodwall, new storm drain pipe from Donahue, installation of flap gates, and other pipe improvements.

Contact FirmoGraphs to Learn More

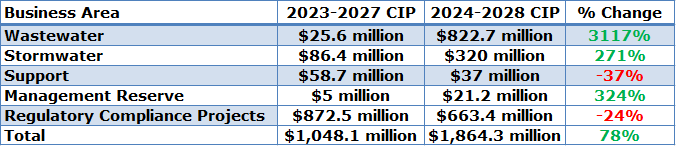

Louisville & Jefferson County Metropolitan Sewer District, Kentucky, Planned Capital Program Increased By 46%

In the CIP covering the 2024-2028 fiscal years, Louisville & Jefferson County Metropolitan Sewer District, Kentucky, detailed plans to spend $2.2 billion on capital projects, an increase of 110% from $1 billion in its 2023-2027 CIP. The current CIP has 451 line items, compared to 170 line items in the prior CIP. The table below breaks down Louisville & Jefferson County Metropolitan Sewer District’s planned capital spending by business area for its last two CIPs.

Increases Due to New Projects

Planned spending in the Wastewater category increased by 3,117% or almost $800 million due to 235 new projects added, including the Morris Forman Water Quality Treatment Plant Biosolids Facility. While in the Stormwater category, 37 more projects were added in the recent CIP including Paddy's Run FPS Capacity Upgrade. Despite fewer projects, the Regulatory Compliance Projects also increased by 110% due to the addition of the Morris Forman WQTC Biosolids Facility, worth $226 million.

Stormwater Projects to Receive Over $200 Million

Out of the 470 line items in the recent CIP, Louisville & Jefferson County has two notable line items valued at over $200 million and two at over $25 million. The largest line item belongs to the Stormwater category, the Paddy's Run FPS Capacity Upgrade, worth $229 million. The other three belong to the Wastewater category. These are the Morris Forman Water Quality Treatment Plant Biosolids Facility, worth $226 million; Upper Middle Fork Relief Interceptor, worth $28 million; and Floyds Fork Interceptor, worth $27 million.

Click Here to See Louisville & Jefferson County Metropolitan Sewer District, Kentucky CIP

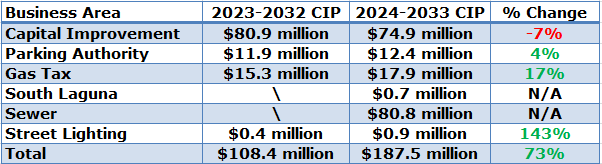

City of Laguna Beach, California, Planned Capital Spending Increased by 73%

In the CIP covering the 2024-2033 fiscal years, City of Laguna Beach, California, detailed plans to spend $188 million on capital projects, an increase of 73% from $108 million in its 2023-2032 CIP. The current CIP has 108 line items, compared to 129 line items in the prior CIP. The table below breaks down City of Laguna Beach’s planned capital spending by business area for its last two CIPs.

Increase Due to New Business Area Added

The current CIP increased largely by 73% mainly because of the added business area, the Sewer category, with nearly $81 million in planned spending. There are 20 projects under this category, and the NCI Reach 1, 2, 3, & 4 Replacements being the largest, worth $24 million. Another $23 million is planned for the South Orange County Wastewater Authority Wastewater Treatment Projects to pay the City's fair share towards SOCWA wastewater treatment projects at the Coastal Treatment Plant (CTP), Regional Treatment Plan, North Coast Interceptor, and the Aliso Creek Ocean Outfall (ACOO).

Sewer Project to Receive $24 Million

The City of Laguna Beach has only one project valued at over $10 million. The project is the NCI Reach 1, 2, 3, & 4 Replacements, belonging to the Sewer category, worth $24 million.

Click Here to See City of Laguna Beach, California CIP

Yucaipa Valley Water District, California, Planned Capital Program, Increased by 16%

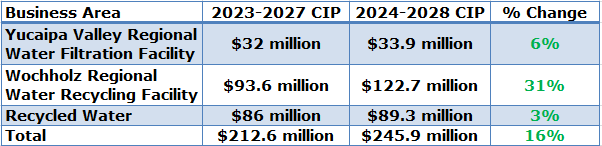

In the CIP covering the 2024-2028 fiscal years, Yucaipa Valley Water District, California, detailed plans to spend $246 million on capital projects, an increase of 16% from $213 million in its 2023-2027 CIP. The current CIP has 66 line items, compared to 69 line items in the prior CIP. The table below breaks down Yucaipa Valley Water District’s planned capital spending by business area for its last two CIPs.

Increases Goes to Existing Projects

All business areas increased. The most significant is the Wochholz Regional Water Recycling Facility, which increased by 31% going to existing projects.

Over $100 Million Programmed for Wochholz Regional Water Recycling Facility Projects

Out of 66 line items, Yucaipa Valley Water District has three notable line items valued at more than $25 million, all belonging to the Wochholz Regional Water Recycling Facility category. The largest project is the Salinity and Groundwater Enhancement (SAGE) Project, worth $43 million. The project will increase recycled water production from 2.25 million gallons per day (mgd) to 4 mgd, producing an additional 1,680 acre-feet of recycled water annually after the SAGE project. Another $32 million is planned for the Energy Resiliency Project - Wochholz Regional Water Recycling Facility, which involves installing a micro-grid energy solution to provide energy resilience through a power purchase agreement (PPA) with Engie Services. Lastly, $30 million is planned for the Oak Valley Sewer Lift Station, Force Mainlines, and Gravity System Improvements-Phase 11.

Click Here to See Yucaipa Valley Water District, California CIP

Notable M&A

The following M&A transactions in the Water and Wastewater Industry stood out in the month of October:

- On October 2, 2023, Aegion Corporation, the leading provider of infrastructure maintenance, rehabilitation and technology-enabled water solutions, announced the acquisition of 11 Enviro Group, a provider of assessment, maintenance, and trenchless services for water and wastewater pipelines in the New York City metropolitan area.

- On October 2, 2023, NW Natural Water Company, LLC, a wholly-owned subsidiary of Northwest Natural Holding Company, completed the acquisition of Rose Valley Water Company, a water utility serving approximately 2,400 connections in Peoria, Arizona, a major suburb northwest of Phoenix.

What We Are Reading

Here are some recent articles our team has been reading:

- New Orleans aims to secure fresh water with $120-$200 million pipeline project

- EPA Makes nearly $125 Million Investment to Spur Wastewater Infrastructure Improvements Across New Jersey

- EPA Makes $336 Million Investment to Spur Wastewater Infrastructure Improvements Across New York State

- Granite secures $45 million contract for Utah's SR-108 infrastructure upgrades

- Governor Hochul secures $234.5 million for New York water infrastructure

- Biden-Harris Administration Announces $330 Million WIFIA Loan to Reduce Air Emissions from Wastewater Treatment Plants in Missouri

- Federal, local officials secure $450 million dredging deal to clean up Milwaukee waterways

- Fairbanks Morse Defense awarded $31 million contract to refurbish Arkansas stormwater pumping station engines

- AECOM partners with U.S. clients to leverage $7.5 billion in water infrastructure funding

- EPA selects six communities to receive technical assistance to improve stormwater management

- Biden-Harris Administration Announces $76 Million WIFIA Loan to Strengthen Climate Resilience in Northern Monterey County, California

- Wisc. governor allocates $402 million to combat PFAS, water infrastructure projects

- Stantec initiates final design phase for $100 million section of Florida water pipeline

- Collaborative $200 million investment targets Oklahoma's water infrastructure

- Texas amendment could provide $1B for water infrastructure projects

- Biden-Harris Administration Announces $120 Million WIFIA Loan to Strengthen Climate Resilience in Florida

- Born after Superstorm Sandy's destruction, 2 big flood control projects get underway in New Jersey

- New York governor secures over $108.8 million for local water infrastructure projects

- Biden-Harris Administration Announces $336 Million Loan to Chicago to Help Remove 30,000 Lead Pipes Across the City

- Wisconsin partners with EPA to replace lead service lines, improve drinking water in 10 communities

- Chicago to replace 30,000 lead pipes with $336 million WIFIA loan

Meeting Planner

There is no replacement for face-to-face meetings with your prospects and customers! We track meetings of interest to our customers serving the US water and wastewater industry so you won’t miss upcoming meetings and deadlines. Also, FirmoGraphs has recently implemented a free-of-charge service for tracking notable infrastructure events.

Meetings in November and December 2023

|

Name Organization |

Name Meeting Key |

Date Start |

Date End |

|

Engineers' Society of Western Pennsylvania |

2023-11-12 |

2023-11-16 |

|

|

Association of California Water Agencies |

2023-11-28 |

2023-11-30 |

|

|

American Water Works Association |

2023-12-05 |

2023-12-07 |