Every year senior management faces important decisions about how to deploy resources to grow revenue. This is critical irrespective whether you are a small, rapidly-growing software company focused on new customer acquisition, or a mature construction and engineering firm looking to expand within existing accounts.

One often overlooked way to optimize growth includes how your business is making sales (account development) assignments. Understanding your customer base and particularly within industrial markets requires properly tagged account data supported by the presentation of that information using business Intelligence (BI) capabilities.

Optimal Territory Assignment Questions:

-

How do we develop and support our customers? By Geography? Industry? Both? With industrial products and services, the answer is often “both”, making the optimization a bit more challenging.

-

Do we sell to the Corporate Organization level, the Site level, or a both? For complex sales cycles, will people from major Sites be involved, and if so, should we be developing relationships with them?

-

For our target accounts, where are the Corporate and Site locations, and what customer staff are located at each? In selling industrial solutions, it is often useful to know what sites could benefit from each solution.

-

Where are our account teams located, and do we make assignments to minimize travel, optimize the application of team subject matter expertise (SME), or both? The best SMEs for a given account may not be in the right time zone, but expertise may trump location.

-

How do we handle account team continuity with the customers, leveraging what may be multi-year relationships, at the same time that we optimize for the current year? Care must be taken not to “churn” deep customer relationships, allowing competitors a chance to gain ground in the account.

With properly tagged lead, contact, account, billing, sales expense, and opportunity data made available to a capable BI software package, answering the questions above and others not listed can be enlightening. Too often, senior leadership lacks these insights as they plan their investment in growth. This puts them in a position where instinct not data is used to justify resource assignment.

HQ location and industry can be important considerations in territory assignment. Leadership wants their B2B capture teams to have access to corporate HQ staff, so knowing where the HQs are can help.

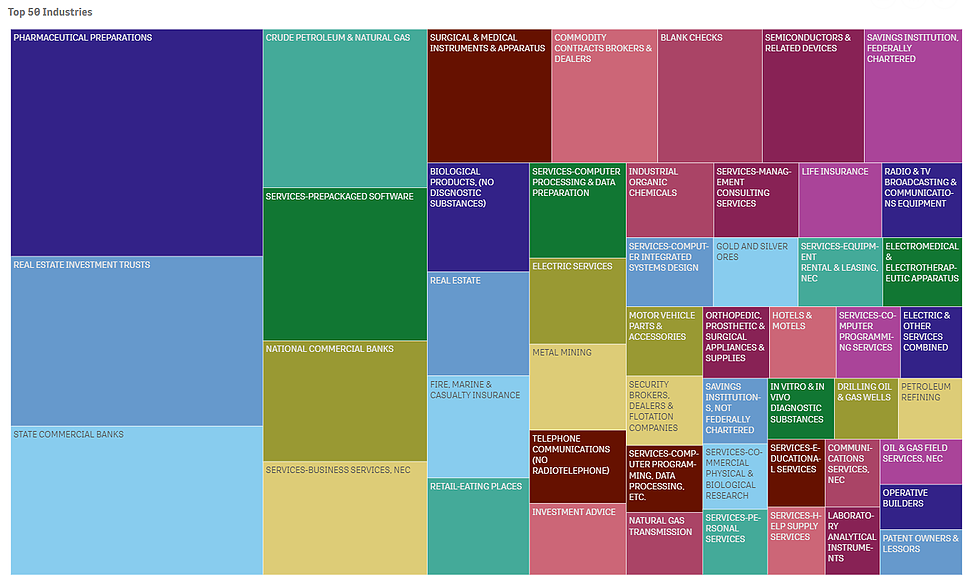

There are more than 5,000 organizations that do annual reporting to the SEC. These are companies with more than $10 million in assets and a securities held by more than 2000 owners, irrespective of whether they are publicly traded. A number of these are shell companies, or are otherwise unlikely targets for B2B sales. Nationwide, the top 50 reporting industries, based on the count of reporting organization, are shown in a treemap format here. The size of the block indicates the number of companies in that sector.

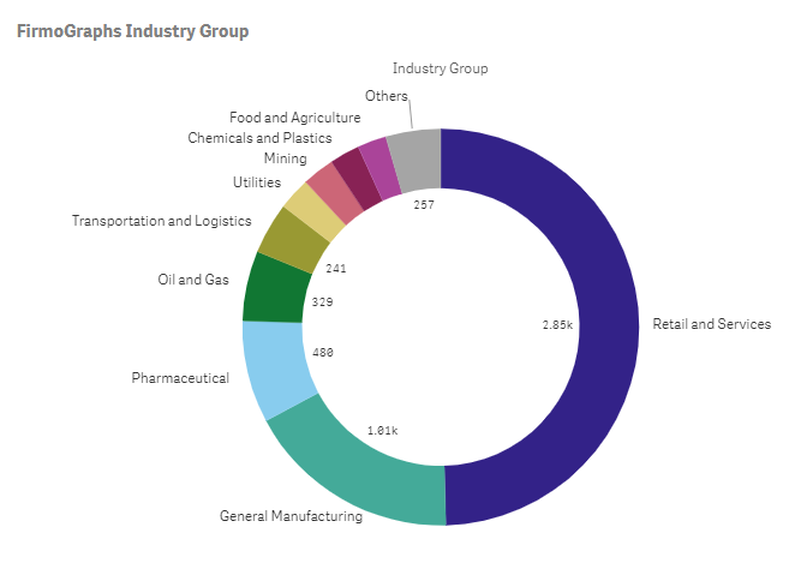

With a heavy industrial focus, we further consider different “super” groups of industries, based on their buying behavior, for example how companies purchase environmental services.

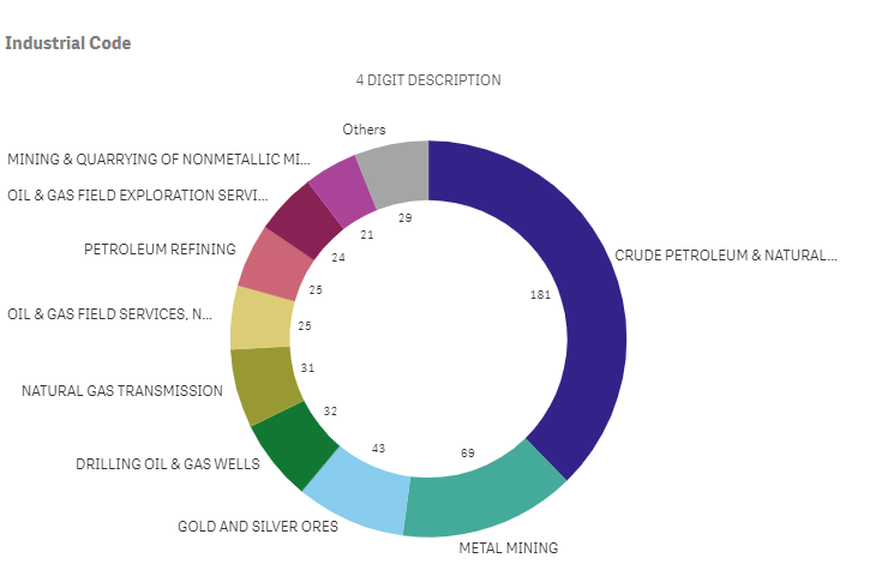

Focusing further on extractive industries, Oil and Gas plus Mining, the number of viable publicly-held companies is narrowed-down to less than 400.

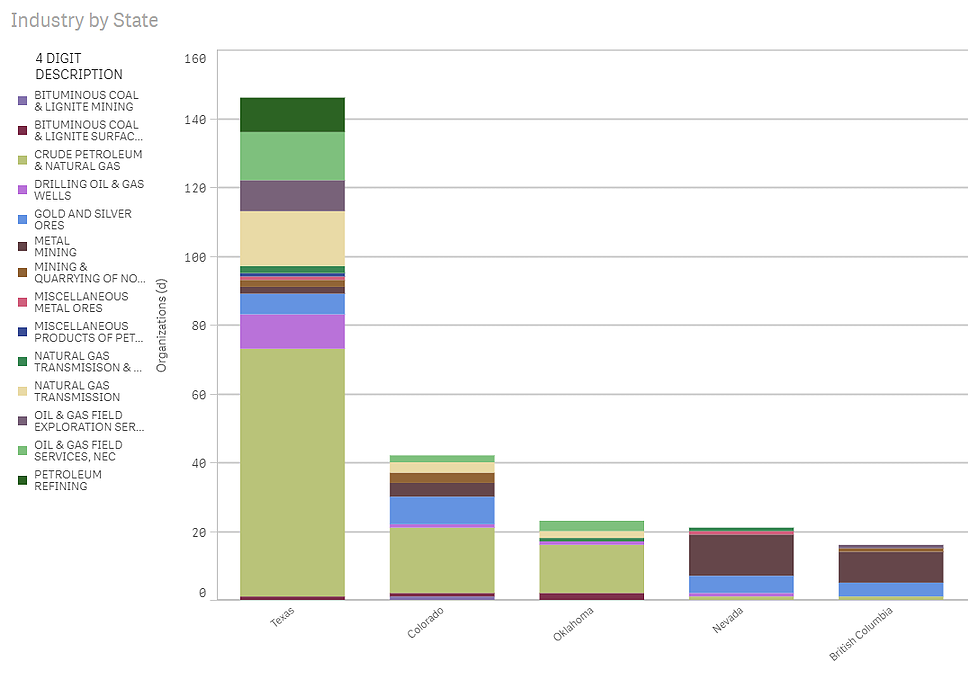

With this focus, we can consider HQ locations by North American state/province.

It isn’t surprising that Texas leads the charts for North American HQ of extractive industry companies. We found it interesting, and a bit surprising, that Oklahoma, Nevada, and British Columbia Canada were all about equal in terms of HQs.

Netting this out, consider that:

-

It is very possible, with the right solution, to use BI for...business and territory planning.

-

Making the right resource allocation decisions can make the difference between a growing or flat revenue year. Between markets and customers being underserved, or opportunities missed.

-

Informing your decisions with BI helps speed the whole process, and garner acceptance for the plan. Good data trumps opinions in strong organizations.

-

This is a superficial, but illustrative example of the type of analysis that is possible.

-

In this work, we applied Qlik Sense™ enterprise to FirmoGraphs curated data on publicly traded companies. Mashing-up multiple data sets yields even more-interesting results, and Qlik makes this relatively easy.

Happy hunting in the new year!

Click below to download our E-Book on 5 Critical Actions you can take to make your marketing more insight-driven, using Business Intelligence.

You might also want to read our blog, 'Technographics and the Industrial IT/OT Landscape'.

Disclaimer

- None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

- Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.