With inflation, supply chain problems, a labor shortage, and a possible recession looming, it’s a challenging time to be an infrastructure contractor.

Fortunately, the federal government is making it somewhat easier from a funding perspective.

The recent enactment of the Inflation Reduction Act (IRA) means there are now three bills that have become law under the Biden administration that contain funding to promote infrastructure spending. The first two, which were passed in 2021, are the American Rescue Plan Act of 2021 (ARPA) and the Infrastructure Investment and Jobs Act or Bipartisan Infrastructure Law (BIL).

Even better, each act has its own timetable, meaning that contractors will be able to find projects resulting from them from now through at least 2032.

In this blog, we’ll look at the acts, their timetables and where news about the projects they wind up funding can be found. After that, we’ll relate how FirmoGraphs can help infrastructure contractors find the projects that are best suited for them to bid on.

IRA Will Spur Renewable Projects for at Least a Decade

If you follow the path of legislation in Washington, D.C., you may remember that the BIL was supposed to be accompanied by a companion piece of legislation called the Build Back Better bill that had a large focus on taking steps to both slow global warming and mitigate its effects.

Of primary interest to infrastructure contractors is the work it could provide them, and there’s a lot of it, most of which is aimed at decarbonizing the nation’s electric grid. The Department of Energy calls the IRA a “$369 billion investment in the modernization of the American energy system” that, in combination with other measures, such as the BIL, will help bring “2030 economy-wide greenhouse gas emissions to 40% below 2005 levels.”

One way it will do that is by extending the program that provides investment tax credits (ITCs) and production tax credits (PTCs) for solar and wind energy through 2024 and then replacing it with a program that provides ITCs and PTCs for zero and, in some cases, very low, carbon energy through 2032, according to Evergreen Action, a Seattle-based group promoting a national climate policy.

Hooking up all that new generation will require some spending on transmission infrastructure and the IRA contains provisions to encourage that.

One appropriates $2 billion for a direct loan program for the development of transmission projects in National Interest Electric Transmission Corridors (NIETCs), according to the Congressional Research Service. The Department of Energy may designate an area as an NIETC if building transmission infrastructure in it would alleviate transmission congestion or enable the development of renewable generation.

Another provision appropriates $760 million for grants that would facilitate the siting of certain transmission lines by providing transmission siting authorities with funding that could be used to perform transmission siting studies, examine alternative transmission corridors, and participate in federal and state regulatory proceedings, among other things.

The IRA also contains a provision authorizing a tax credit for energy storage facilities, according to Canary Media. Previously, their developers had only been able to get tax credits for them by including them in renewable generation projects that were receiving credits. Analyst firm Wood Mackenzie estimates that the credit will boost the amount of grid-scale storage developed in the U.S. over the next 10 years to 122 gigawatts, up from its previous estimate of 100 GW.

In all, Wood Mackenzie estimates the IRA will result in more than $1.2 trillion being invested in renewable generation between now and 2035, with annual investment in renewable generation doubling to $80 billion by the end of the decade.

Energy infrastructure contractors looking to find projects to bid can start by looking at the interconnection queues of the nation’s regional transmission organizations (RTOs) and independent system operators (ISOs). A study that was led by the Lawrence Berkeley National Laboratory and released in April found those queues contained more than 1,300 gigawatts, or $2 trillion, of wind and solar generation and energy storage projects that their developers were seeking to have connected to the grid.

Contractors looking for renewable or storage projects to bid on also can find them in filings their developers make with state utility regulatory commissions and in press releases from the developers themselves. The transmission projects that will be needed to bring those renewable and storage projects online also can be found in those filings and press releases. Additionally, renewable generation and transmission developers, utility commissions and RTOs and ISOs usually make announcements when major projects are approved.

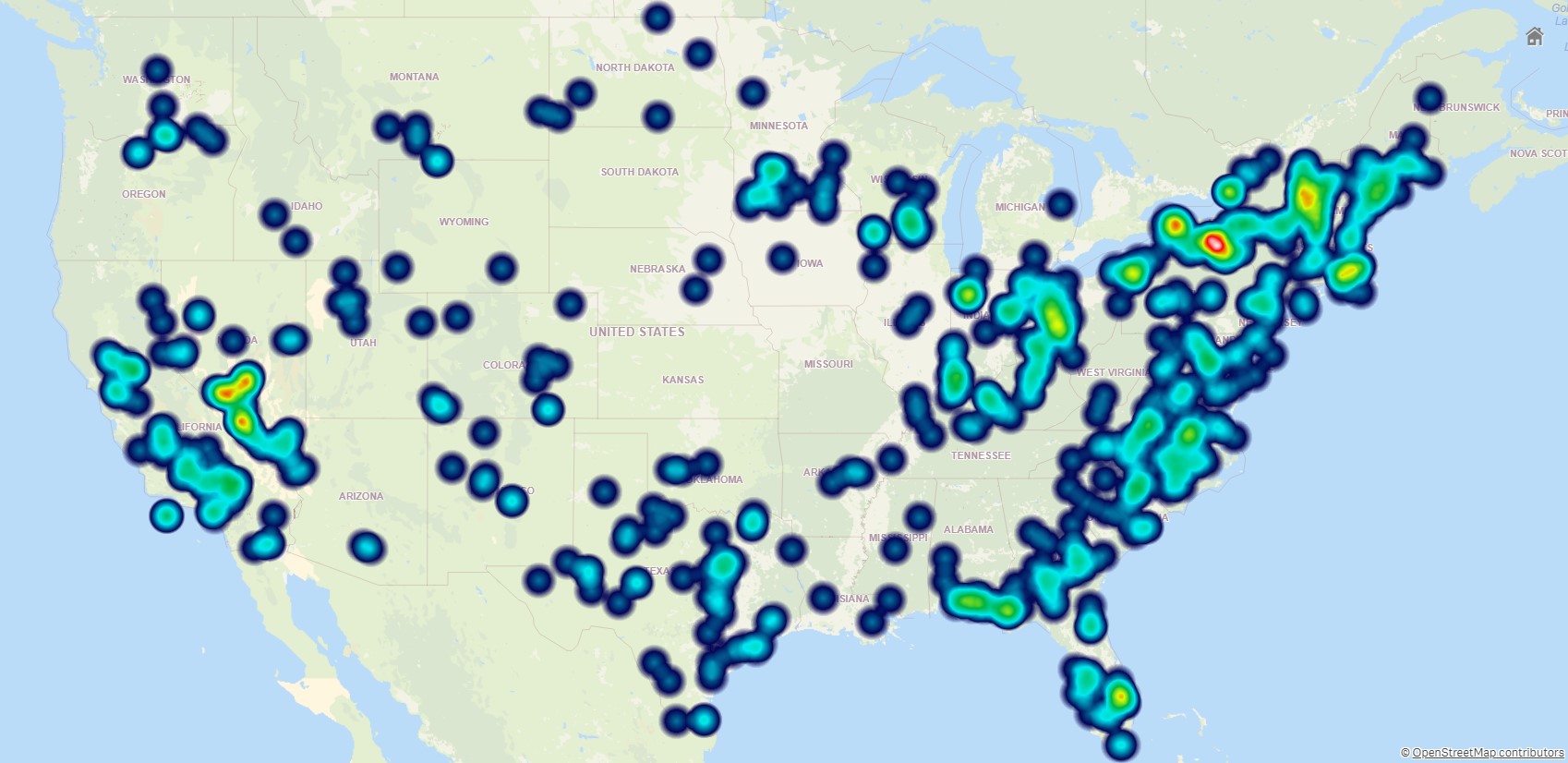

Heatmap of solar and wind projects FirmoGraphs is tracking with construction years starting 2022 - 2025

Transportation Infrastructure is a Big Winner with BIL Money

The BIL authorized $1 trillion in spending on infrastructure, consisting of roughly $450 million in spending the government already had planned to do and $550 million in new spending. We detailed its major provisions in our blog prior to the bill’s passage last year and the White House put out a fact sheet on the bill after it cleared Congress.

Among the biggest allocations in the bill were $110 billion in new funding for roads, bridges, and transformational projects; $89.9 billion for public transit; more than $65 billion to upgrade the power grid; and $55 billion to expand access to clean drinking water, in part by replacing lead service lines across the country.

Money from the BIL began flowing in summer, resulting in more than 5,300 projects getting started across the country, according to CNN. Federal agencies have been announcing awards to projects and the creation of new offices and programs to distribute money from the BIL this year and in the future.

This shows how much money has been allocated to each state under the BIL through July

The Department of Transportation has been particularly busy, announcing $2.2 billion in funding for 166 projects through its Rebuilding American Infrastructure with Sustainability and Equity (RAISE) program; $1.5 billion in Infrastructure for Rebuilding America (INFRA) grants for highway, multimodal freight and rail projects; and more than $1.4 billion in Consolidated Rail Infrastructure and Safety Improvement (CRISI) grants.

The Department of Energy, meanwhile, has created the Grid Deployment Office, which will invest $17 billion in programs and projects that bring together community and industry stakeholders to identify and address national transmission, distribution, and clean generation needs, and programs to keep nuclear power plants from retiring.

And the Environmental Protection Agency has awarded more than $1.8 billion in capitalization grants to 18 states for water infrastructure improvements.

As you can see from the previous three paragraphs, monitoring the websites of federal agencies administering BIL funds is one way to learn of projects being funded by the act. State and local governments and agencies also often will announce projects receiving BIL funding, as will elected officials interested in being associated with them.

Uses of ARPA Money Being Chosen

We detailed ARPA on the blog last year. The bill authorized $1.9 trillion in funding to help the economy recover from the COVID-19 pandemic and is best known for having enabled more than 170 million Americans to get $1,400 stimulus checks.

More to the point for infrastructure contractors, it also established the Coronavirus State Fiscal Recovery Fund and the Coronavirus Local Fiscal Recovery Fund to provide $350 billion in emergency funding to eligible state, local, tribal, and tribal governments. That was notable because those governments could and can use money from the funds to invest in water, sewer, and broadband infrastructure.

The blog post linked to above detailed in broad terms how and when the money for the funds was being distributed. But even though the post is a year old, many government entities that have received ARPA money are still announcing the projects they’ll fund with it.

For example, the Idaho Water Resource Board recently voted to spend approximately $87 million in ARPA) funds on a number of major water infrastructure projects, including raising Anderson Ranch Dam by six feet to create an additional 29,000 acre-feet of storage water, according to LocalNews8.com.

Connecticut Gov. Ned Lamont late last month announced plans to use $42.9 million of ARPA funding to increase broadband availability in underserved areas.

And Cleveland County, Oklahoma, commissioners recently approved initiatives to spend $23.4 million in infrastructure, including $9.6 million on infrastructure, according to The Norman Transcript.

As the previous three paragraphs demonstrate, contractors can find projects receiving ARPA funding by monitoring the websites of state and local agencies and authorities, as well as the websites of the media outlets that cover them..

Let’s Meet

As we said at the beginning of this blog, the three big spending bills passed under the Biden administration are currently funding projects of interest to infrastructure customers and will fund many more in the future — out to at least early next decade in the case of the IRA.

And, as we said throughout the blog, there are many websites that contractors can monitor to learn of those projects.

Alternatively, contractors can turn to us. At FirmoGraphs, we track announcements by and filings with federal, state and local government agencies, as well as news regarding them and big infrastructure project developers. We also track projects that state and local governments and agencies across the country want to do by collecting their capital spending plans.

All of this enables us to offer customers access to a searchable database that, with our help, they can use to find the most promising projects for them to bid on. Additionally, they can learn of these projects early enough to familiarize themselves with the organizations seeking bids on them, so they know what those organizations are looking for.

If you’re interested in seeing how we can help you, feel free to request a meeting and review our data live in our business intelligence platform.