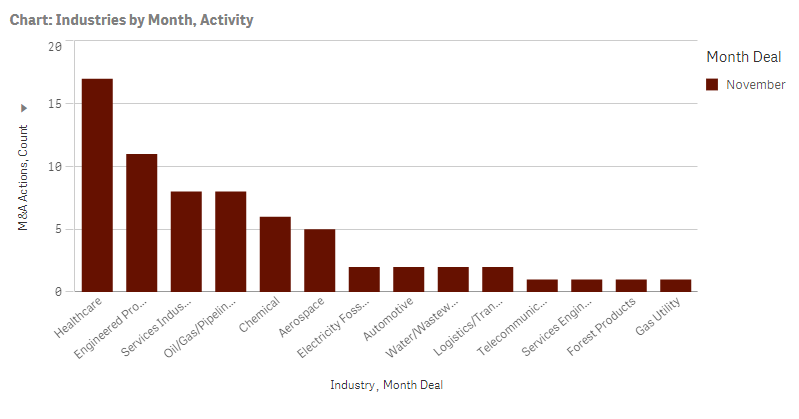

FirmoGraphs recorded a slightly lower level of activity in November, with 67 completed transactions related to the North American market in 14 different industries.

The most active industry was healthcare, with 17 completed transactions. As always, our focus is on those operationally-intensive industries that are of interest to our clients (utilities, manufacturing) rather than less asset-intensive markets (retail, banking).

Utilities

There were six completed transactions in the utilities industry last month. Two of those transactions related to renewable energy, and in the water space Central States Water Resources expanded its presence in Kentucky and Arkansas.

Oil Industry

The month of November shows eight completed transactions in the oil industry, that include a few significant transactions. The one that stands out is Chevron’s sale of part of its overseas fields for $2.0 billion.

Engineered Products

The industry of engineered products wasn’t active in November as usual. Our records show total 11 completed transactions during last month. However, that doesn’t mean there weren’t any significant transactions. Among others, Hillenbrand acquired Milacron for $1.9 billion.

Healthcare

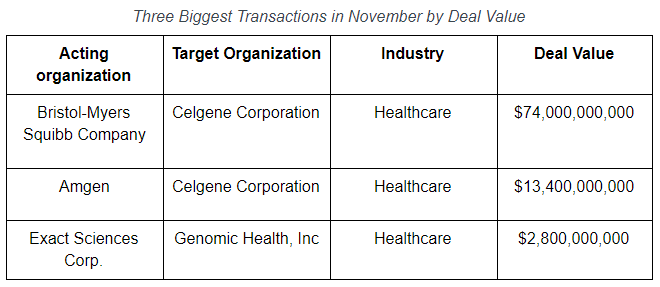

As mentioned earlier, healthcare was the most active industry in November, with 17 completed transactions. What a month it was! Bristol-Myers Squibb and Celgene completed one of the biggest pharmaceutical deals ever. After almost a year of combined efforts, they completed the $74.0 billion merger. As part of the same transaction, Celgene sold ist worldwide rights to Otezla and related assets to Amgen for $13.4 billion.

It is also worth mentioning that Exact Sciences and Genomic Health, completed their $2.8 billion worth merger, and that Roche and Spark Therapeutics extended the deadline for their $4.3 billion worth transaction once again.

Other industries

In other industries, the only transaction worth mentioning is a completed partnership between CVC Fund II and aerospace parts producer Ontic, valued at $1.3 billion.

Largest Transactions

Announced Future Deals

In addition to completed transactions, FirmoGraphs recorded over 40 announced future deals. Some of those are expected to be very significant after they’re concluded and are listed below:

- Novartis’ planned acquisition of The Medicines Company for $9.7 billion;

- Stryker’s $4.0 billion worth acquisition of Wright Medical Group;

- $2.63 billion worth purchase of renewable power producer Pattern Energy Group by the Canada Pension Plan Investment Board.

It looks like the healthcare industry is continuing with its steady pace, just like the renewable energy sector.

Merger Cartoons

Conclusion

FirmoGraphs watches North American industrial news and curates a normalized version of monthly merger and acquisition information. This way, you can leverage the Merger Mart along with others (such as Power, Water) to generate your own unique observations for the US industrial market.

Our favored BI solution, Qlik Sense™ Enterprise, makes mashing-up multiple data sets fun and easy. Our customers find new opportunities to grow revenue, and reduce risk, by combining the Merger Mart with their own proprietary CRM and market data.

Having a good understanding of customer M&A activities can be key to the health of your business. Click here to learn more.

Click below to download our e-Book on 5 Critical Actions for an insight-driven marketing using Business Intelligence.

Disclaimer

None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.