Dear Readers

We are pleased to share FirmoGraphs' North American Merger and Acquisition (M&A) Report for the month of June.

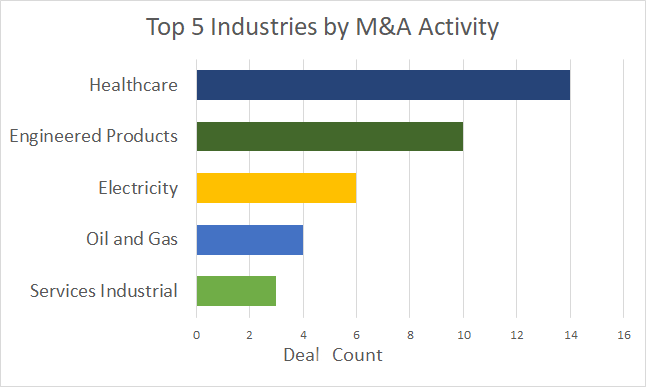

In the previous month, we recorded 53 completed transactions related to the North American M&A market in 11 different industries. With 14 completed deals, the Healthcare industry stands out again!

As always, our focus is on those operationally-intensive industries that are of interest to our clients (utilities, manufacturing) rather than less asset-intensive markets (retail, banking).

COVID-19 impact on the M&A market

The COVID-19 pandemic came as a surprise. Most of the world was unprepared, which led to massive negative overall effects. These effects include a considerable decrease in economic activity all around the world and a change in the way some industries will operate for at least some time during and after the pandemic. The M&A market was not immune to these effects.

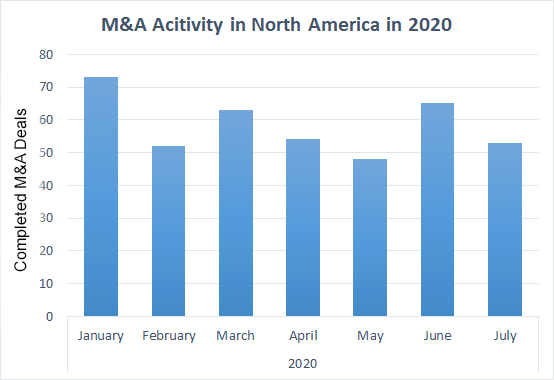

In our last blog post, we mentioned that M&A activity increased for the first time since the start of the pandemic and that that could be a sign of the recovery of the M&A market. However, as shown in the chart above, the M&A activity dropped again, both in terms of the number of completed deals and deal value.

This is the result of the current COVID-19 situation in North America. July was the worst month in the U.S. since the pandemic started. According to the official data, the number of new cases surged, resulting in breaking many negative records, including more than double the number of new cases in any previous month. Also, the average death toll doubled during July.

Combine those negative trends with catastrophic economic data (U.S. GDP dropped 32.9% in Q2 2020) and political uncertainty caused by forthcoming U.S. elections and U.S-China tensions, and it is understandable why companies in North America are restrained from being more active on the market. With all uncertainty currently covering the world and the global economy, and the fact that the U.S. is the country hit by the pandemic more than most other parts of the world, it is hard to predict how the market is going to develop in the future. If the situation doesn’t show signs of improvement in the near future, businesses will likely have to adapt even more, and M&A activity is certainly going to reflect that, one way or another.

Utilities

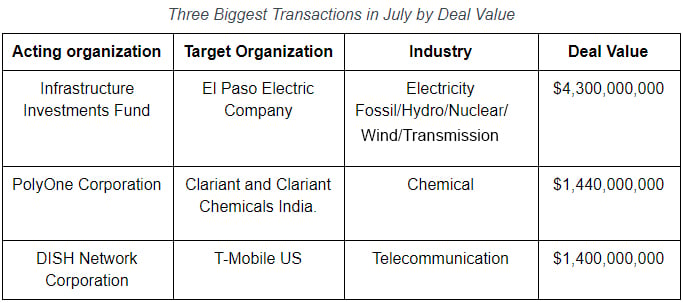

There were 11 completed transactions in the utility industry last month. By far, the most significant one was the completed acquisition of El Paso Electric Company by Infrastructure Investments Fund in a deal worth $4.3 billion.

Interestingly, for the first time in the last 12 months, we didn’t record any water/wastewater deal for the given month.

Oil Industry

The oil industry had four completed transactions in July. The only deal worth mentioning was National Fuel Gas Company’s acquisition of integrated upstream and midstream gathering assets in Pennsylvania from Royal Dutch Shell for $0.5 billion.

Engineered Products

Although there were ten completed M&A deals in the engineered products industry, the most significant thing was the EU’s approval of Alstom and Bombardier’s deal worth $6.7 billion. The deal that is going to make Alstom the second-largest rail manufacturer in the world is expected to close in the first half of the next year.

Healthcare

Once again, the healthcare industry was the most active industry, with 14 completed M&A deals in July. However, as in the engineered products industry, the most interesting deal was not the one that was completed last month. It was the amendment of the terms of Thermo Fisher’s acquisition of QIAGEN. Due to this amendment, the deal value is now above $12.5 billion.

Other industries

Among the deals in other industries, only one deal stands out. It was PolyOne Corporation’s purchase of Clariant’s color masterbatch business for $1.44 billion.

Largest Transactions

Announced Future Deals

In addition to completed transactions, FirmoGraphs recorded almost 30 announced future deals in ten different industries. Among the announced deals, a few are particularly significant:

- Analog Devices’ acquisition of Maxim Integrated Products for $20.91 billion;

- Berkshire Hathaway’s acquisition of Dominion Energy’s natural gas assets for $9.7 billion;

- Chevron’s purchase of Noble Energy for $5.0 billion.

Conclusion

FirmoGraphs watches North American industrial news and curates a normalized version of monthly merger and acquisition information. This way, you can leverage the Merger Mart along with others (such as Power, Water) to generate your own unique observations for the US industrial market.

Our favored BI solution, Qlik Sense™ Enterprise, makes mashing-up multiple data sets fun and easy. Our customers find new opportunities to grow revenue, and reduce risk, by combining the Merger Mart with their own proprietary CRM and market data.

Having a good understanding of customer M&A activities can be key to the health of your business. Click here to learn more.

Wish to learn more about applying BI to your approach in the North American merger and acquisition tracking in the US utility? Please click here.

Click below to download our e-Book on 5 Critical Actions for an insight-driven marketing using Business Intelligence.

Disclaimer

None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.