Dear Readers,

Here’s our M&A report for the month of August. We’ll look forward to your feedback about this blog, in the form of your comments.

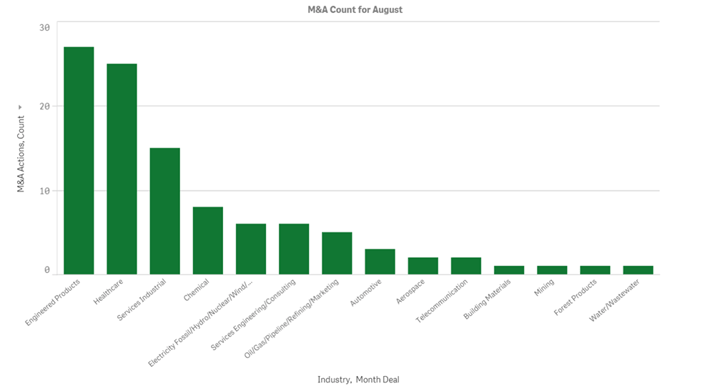

In August, FirmoGraphs recorded a slightly higher level of activity, with 103 completed transactions related to the North American market in 14 different industries.

Engineered products (27 completed transactions) and healthcare (25 completed transactions) were the most active industries in August.

As always, our focus is on those operationally-intensive industries that are of interest to our clients (utilities, manufacturing) rather than less asset-intensive markets (retail, banking).

Utilities

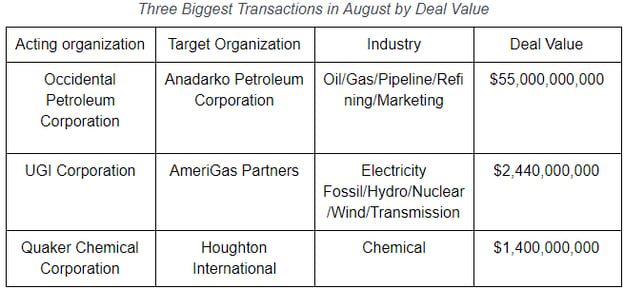

FirmoGraphs recorded nine completed transactions in the utilities industry. The most significant one was the $2.44 billion worth merger between UGI Corporation and AmeriGas Partners.

Oil Industry

The month of August shows five completed transactions in the oil industry. The biggest one being Occidental’s $55.0 billion worth acquisition of Anadarko Petroleum. This was also the biggest completed transaction in August in all industries.

Engineered Products

As mentioned earlier, the engineered products industry was the most active sector in August, with 27 transactions. The biggest transaction was Advanced Drainage Systems’ acquisition of Infiltrator Water Technologies for $1.08 billion.

Healthcare

Healthcare again, was one of the most active industries, with 25 completed transactions. Among others, Agilent Technologies completed the acquisition of BioTek Instruments in a transaction valued $1.165 billion.

Other industries

The other large transaction we tracked was the $1.4 billion merger between Quaker Chemical and Houghton International.

Largest Transactions

Announced Future Deals

In addition to completed transactions, FirmoGraphs recorded almost 50 announced future deals. Some of those are expected to be very significant after they’re completed and are listed below:

- Amgen’s acquisition of Celgene’s drug Otezla for $13.4 billion;

- Hilcorp Energy’s $5.6 billion worth acquisition of BP’s Alaskan business;

- $3.3 billion worth acquisition of Kinder Morgan and U.S. portion of the Cochin Pipeline by Pembina Pipeline.

Conclusion

FirmoGraphs watches North American industrial news and curates a normalized version of monthly merger and acquisition information. This way, you can leverage the Merger Mart along with others (such as Power, Water) to generate your own unique observations for the US industrial market.

Our favored BI solution, Qlik Sense™ Enterprise, makes mashing-up multiple data sets fun and easy. Our customers find new opportunities to grow revenue, and reduce risk, by combining the Merger Mart with their own proprietary CRM and market data.

Having a good understanding of customer M&A activities can be key to the health of your business. Click here to learn more.

Wish to learn more about applying BI to your approach in the North American merger and acquisition tracking in the US utility? Please click here.

Click below to download our e-Book on 5 Critical Actions for an insight-driven marketing using Business Intelligence.

Disclaimer

None of the information we provide may be taken as legal advice. Please consult an attorney if you require a legal interpretation of this information.

Any information contained on this website or within any attachments is offered without representation or warranty as to its accuracy or completeness and FirmoGraphs, LLC cannot be held responsible for loss or damage caused by errors, omission, misprints or your misinterpretation of such information. Seek competent professional advice prior to relying on or utilizing such information in any manner as any such use is at your own risk.